US DOLLAR IMPLIED VOLATILITY SPIKES AHEAD OF OCTOBER FED MEETING & GDP DATA RELEASE

- USD price action edged lower ahead of the FOMC rate decision and Q3 US GDP report alongside several other high-impact data releases and events slated for Wednesday’s trading session

- The US Dollar could resume its downtrend if the Fed indicates its commitment to keeping financial conditions accommodative or hints at ramping up monetary policy operations

- Check out this analysis on historical US Dollar volatility around Fed meetings

The US Dollar came under renewed selling pressure early Tuesday following a disappointing consumer confidence report. Downside was relatively limited, however, as forex traders remain focused on high-impact event risk scheduled throughout Wednesday’s trading session that will likely warrant a stronger reaction in the US Dollar. Taking the spotlight will be the Q3 US GDP report and latest FOMC rate decision which are expected to cross the wires at 12:30 GMT and 18:00 GMT respectively.

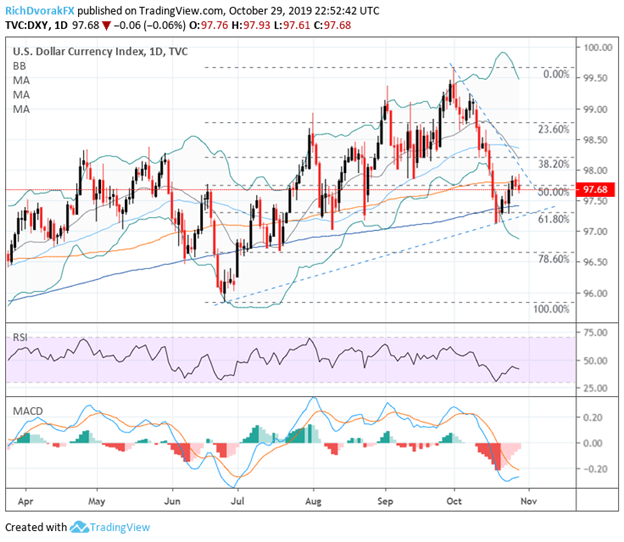

US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (MARCH 25, 2019 TO OCTOBER 29, 2019)

Chart created by @RichDvorakFX with TradingView

The DXY Index – a popularly referenced basket of major USD currency pairs – pivoted lower after flirting with technical resistance posed by its 100-day simple moving average, which I noted as a likely possibility in the US Dollar Price Volatility Report published Monday. Nearside technical support could potentially be provided by the US Dollar’s 200-day SMA and 61.8% Fibonacci retracement of its bullish leg from June’s low to October’s high whereas the 50-day SMA and 38.2% Fib pose as technical resistance. That said, the swath of fundamental information forex traders will be forced to digest over the next 24 hours and throughout the rest of the week could very well determine whether the US Dollar will resume its recent selloff or continue to rebound higher.

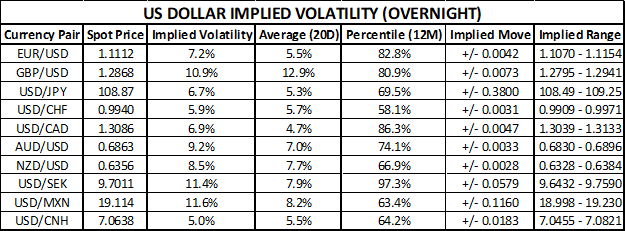

US DOLLAR IMPLIED VOLATILITY & TRADING RANGES (OVERNIGHT)

As previously mentioned, the latest overnight US Dollar implied volatility readings just spiked, which is to be expected with a rise in risk and uncertainty stemming from high-impact economic events and data releases. Aside from the October Fed meeting and Q3 US GDP report, Wednesday’s trading session has an abundance of fundamental catalysts that could spark some serious USD price action – particularly when considering event risk not specific to the US Dollar like a monetary policy update from the BOJ, another rate decision from the BOC and inflation data out of Australia and Germany. Consequently, EUR/USD, USD/JPY, USD/CAD and AUD/USD come into focus.

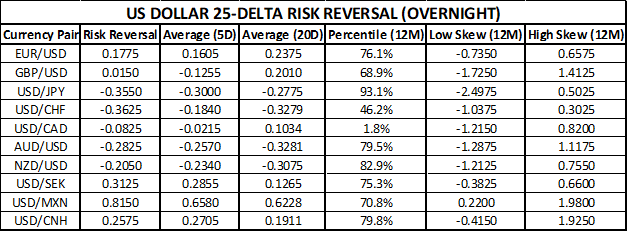

US DOLLAR RISK REVERSALS (OVERNIGHT)

Generally speaking, overnight US Dollar risk reversal readings suggest that forex options traders have a bearish bias on the greenback headed into Wednesday’s trading session. A risk reversal reading above zero indicates that the demand for call option volatility (upside protection) exceeds that of put option volatility (downside protection. For additional insight on market positioning and bullish or bearish biases, traders can turn to the IG Client Sentiment data, which is updated in real-time and covers several currency pairs, commodities, and equity indices.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight