US DOLLAR PRICE ACTION: GBP/USD, AUD/USD & USD/JPY IN FOCUS

- The US Dollar will eye the latest consumer confidence report ahead of the October Fed meeting and brings USD/JPY into focus while AUD/USD is highlighted with a speech from the RBA’s Lowe on deck

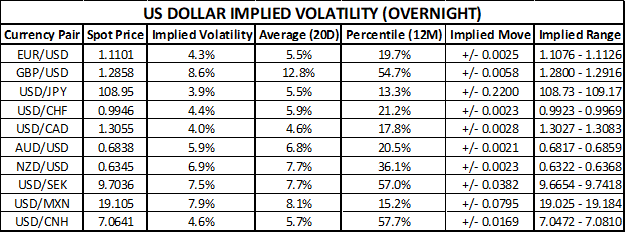

- Check out this US Dollar Price Volatility Report for 1-week implied volatility and trading ranges on major USD currency pairs

- Enhance your market knowledge with our free Forecasts & Trading Guides available for download

The US Dollar wobbled throughout Monday’s trading session with USD price action largely sidelined in light of the upcoming FOMC rate decision due later this week. Looking to Tuesday, however, the greenback could get a jolt from US consumer confidence data set to cross the wires at 14:00 GMT.

Though the consumer confidence report for October is not likely to deter the Fed from providing its third consecutive 25-basis point interest rate cut expected this Wednesday, a print materially above or below consensus estimates could have a sizable impact on the greenback – particularly USD/JPY.

The US Dollar could also swing in response to high-impact event risk out of Australia and the UK with Aussie CPI data and ongoing Brexit drama slated for Tuesday, which brings AUD/USD and GBP/USD into focus.

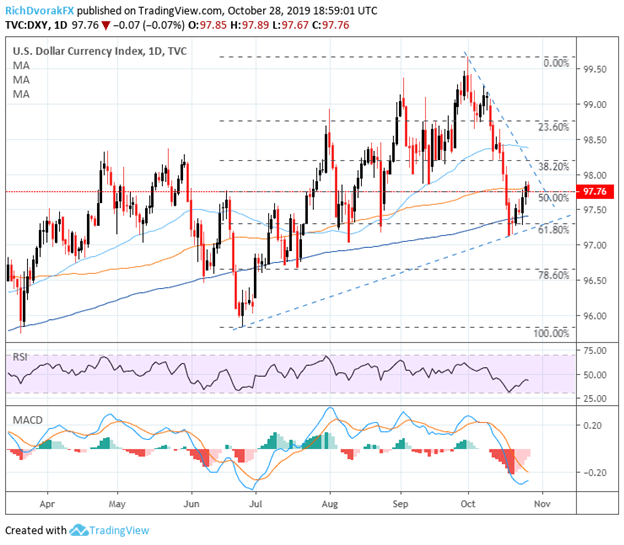

US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (MARCH 14, 2019 TO OCTOBER 28, 2019)

Chart created by @RichDvorakFX with TradingView

As mentioned previously, USD price action is on pace to finish the day roughly flat on balance. Correspondingly, DXY US Dollar Index chart outlook remains unchanged in the absence of a new technical development. The US Dollar has gravitated higher toward its 100-day simple moving average as the greenback attempts to reverse some of its recent downside.

This level of technical confluence is also highlighted by the mid-point retracement of the US Dollar’s trading range since June. Though last week’s claw back of recent downside could seem encouraging to some US Dollar bulls, this zone of technical resistance around the 97.75-98.00 price level could easily thwart the greenback’s rebound. That said, the US Dollar appears bound broadly by technical support and resistance provided by its 200-DMA and 50-DMA as well as the 61.8% and 38.2% Fibonacci retracement levels, respectively.

US DOLLAR IMPLIED VOLATILITY & TRADING RANGES (OVERNIGHT)

AUD/USD – RBA Governor Lowe will be giving a speech Tuesday at 6:45 GMT ahead of an upcoming Australian inflation report set to cross the wires shortly after on Wednesday at 00:30 GMT. Seeing that the RBA’s governing mandate is inflation targeting, the CPI data could cause a sharp reaction in spot AUD/USD prices if the report surprises materially above or below market estimates. For further insight on the Aussie, check out this Australian Dollar Technical Forecast: AUD/USD, AUD/JPY, GBP/AUD.

GBP/USD – The cable is once again expected to be the most volatile US Dollar currency pair during Tuesday’s trading session as traders continue to digest the latest Brexit developments. Most recently, UK Parliament rejected PM Boris Johnson’s initial call for a general election on December 12 falling short of the 2/3 majority required (434 votes backing the proposal) with 299 voting in favor and 70 in opposition. PM Johnson is expected to propose another December 12 general election bill to Parliament again on Tuesday. Although, British MPs can make amendments to the forthcoming proposal, which would require only a simple majority of votes to pass.

USD/JPY – I noted in this US Dollar Price Volatility Report published last week the relationship between Fed monetary policy, consumer outlook and recession risk. This theme comes back into focus Tuesday with the Conference Board’s monthly Consumer Confidence Index report for October, which could warrant a serious change in risk appetite and Fed rate cut expectations for December and beyond.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight