OIL PRICE OUTLOOK – TALKING POINTS

- Oil prices swoon nearly 10 percent over the last 5 trading days as recession fears resurface

- Crude has cratered 5 out of the last 6 weeks amid evaporating bullish sentiment

- Oil commodity traders turn to next week’s barrage of economic data and events for clues to crude’s next move

- Check out this free educational guide discussing the Core Fundamentals of Oil Trading

Last week’s oil forecast highlighted how the global growth narrative was set drive the price of crude. Crude oil prices have since plunged to $53.25/bbl – the lowest level since February 14 – as recession fears resurface amid escalating risks to global economic growth. The release of China’s manufacturing PMI this past Friday showed a contraction and dealt the latest blow to oil prices due to waning prospects for oil demand.

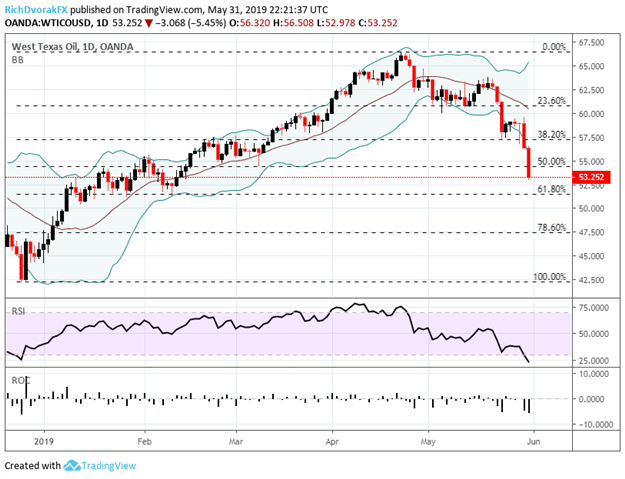

OIL PRICE CHART: DAILY TIME FRAME (DECEMBER 18, 2018 TO MAY 31, 2019)

The impact from Trump tariffs and deteriorating US China trade relations in addition to several other downside risks to global GDP growth have sent crude oil on a 16.5 percent nosedive over the month of May – and prices could still head lower. Market sentiment, as well as oil demand and prices, threaten to deteriorate further considering the barrage of high-impact economic events and data releases next week which look to provide the latest health check on risk appetite and could further spark cross-asset volatility.

Recent crude oil carnage could be curbed, however, if the fundamental backdrop for global growth improves on the back of upbeat data or trade war rhetoric. Strength in the US economy may shine and inspire investor confidence if leading indicators like the ISM manufacturing and services PMI readings surprise to the upside. Although, markets are likely still digesting the looming effect from the US slapping a 5 percent tariff slapped onto all Mexican goods exports with any whiff of downward global GDP growth revisions risking more downside in oil.

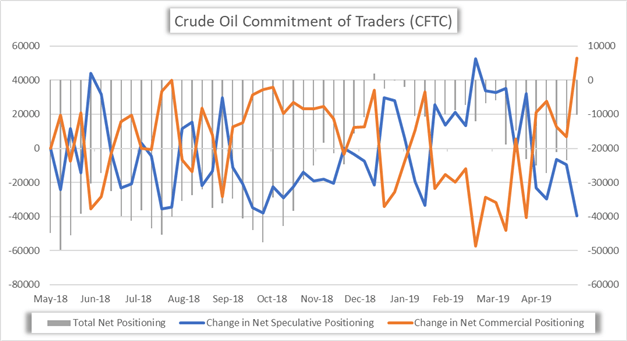

CRUDE OIL – COMMITMENT OF TRADERS (NET FUTURES POSITIONING)

According to the latest CFTC Commitment of Traders data, net oil futures positioning shows a reduction in net short positioning as the volume of commercials longs outpaced that of shorts for the last 5 weeks. The bullish bets from commercial hedgers could provide crude oil prices with a bit of buoyancy, but it is noteworthy that non-commercial speculative futures traders have grown increasingly bearish over the last month as prices spiral lower.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter