OIL PRICE OUTLOOK – TALKING POINTS

- Oil prices cratered over 7 percent last week as rising US China Trade War tension reignites slowing global growth fears

- A slew of economic data releases on tap next week could dictate whether or not crude oil price carnage will continue

- OPEC production, geopolitical tensions and a weakening dollar have potential to bolster oil prices

In our last Oil Forecast we highlighted how crude price outlook hinged on the looming US China trade deal result. Since then, commodity traders have been taken aback by escalating downside risks to crude oil stemming from the deterioration in Sino-American trade relations, bleak economic data, and bulging crude stockpiles. Barring any positive developments regarding US China trade war rhetoric, crude oil prices could continue sliding over the near term as market participants wrestle with the possibility that global economic growth fails to rebound in the second half of the year as expected.

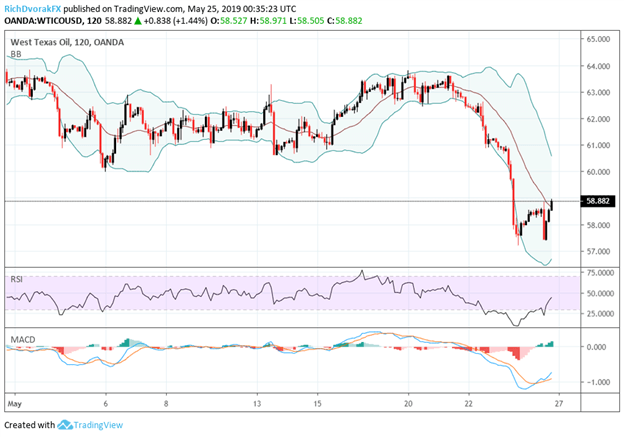

CRUDE OIL PRICE CHART: 120-MINUTE TIME FRAME (APRIL 30, 2019 TO MAY 24, 2019)

A barrage of high-impact economic data points next week spanning US, Swiss and Canadian GDP reports, German jobs numbers, inflation data out of the US and Germany in addition to China’s manufacturing PMI could very well dictate where oil prices head from here. Sentiment may remain damaged if the market-moving data fails to inspire appetite for risk and expected demand for oil which could further threaten bullish prospects.

Although, a weakening US Dollar could pose as a positive tailwind to crude oil price gains. US Iran friction heating up may also bring upside to oil prices as it would likely crimp supplies. Additionally, crude could get a boost from building speculation over extended OPEC production cuts as the oil cartel’s next meeting on June 25 in Vienna draws nearer.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter