CRUDE OIL PRICE FORECAST – TALKING POINTS

- Selling pressure in crude sent oil prices tumbling over 2.5 percent before trimming losses during Friday’s session to finish the week roughly 1 percent lower

- A surprise stockpile build in the US sent oil prices swooning while calls on OPEC to increase production countered the prospect of supply constraints from the expiration of Iranian sanctions

- Crude oil price outlook now shifts focus to the possibility of a US-China trade deal next week which could boost future demand for the commodity if materialized

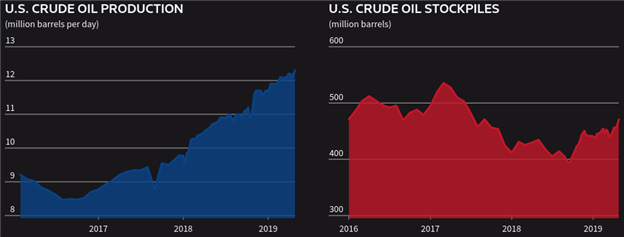

Crude oil dipped 1.17 percent to $62.15/bbl over the last 5 trading days, inking back-to-back weekly losses for the commodity. The primary driver of recent downside could be attributed to reports from the EIA that crossed the wires during Thursday’s session which stated US crude stockpiles skyrocketed 9.9m/bbl to their highest level since September 2017.

US OIL PRODUCTION AND CRUDE INVENTORIES

Source: EIA, Reuters | Henning Gloystein

Ballooning crude oil production in the US now tops 12m/bpd and largely contributed to the recent bulge in oil inventories. The trend looks to continue after the Trump administration announced that the Interior Department released a fresh set of regulations last week that makes offshore oil drilling easier for energy companies.

Furthermore, President Trump continues to demand that OPEC increases its output after oil prices have soared since the start of the year – but the recent threats of higher supply has sent crude plunging in response. Also, Saudi Arabia is already rumored to have plans in place to boost production ahead of an expected spike in domestic demand during the summer.

That being said, the updated EIA short-term energy outlook report is due for release on May 7 and looks to provide oil market participants with the latest comprehensive insight over potential supply and demand imbalances.

OIL DEMAND & US-CHINA TRADE DEAL

Looking forward, however, global demand for crude oil – and consequently its price – hinges principally on the final outcome of US-China trade talks which are now expected to conclude within the next two weeks. A positive outcome where the world’s largest two economies reach a trade deal looks to provide a solid boost to global growth and thus demand for oil.

Although, this scenario has largely been factored into market pricing already and may limit potential upside in oil prices. On the other hand, a negative outcome where the US and China fail to reach an agreement could quite possibly derail bullish prospects for oil demand and prices.

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter