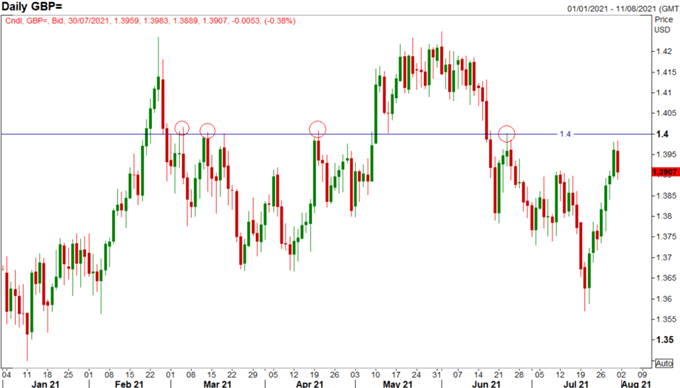

GBP/USDFUNDAMENTAL HIGHLIGHTS:

- GBP Recovers Across the Board

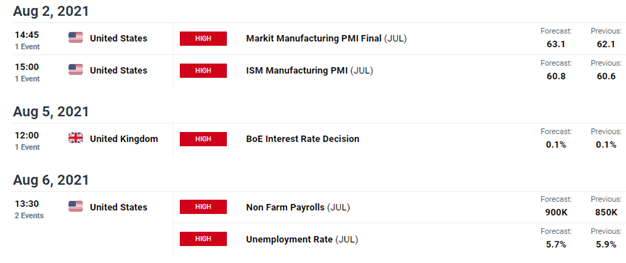

- BoE and NFP the Notable Data Points

The Pound extended on its recovery throughout the week across the board, with major GBP pairs testing key psychological levels. While the weakness in the greenback post-FOMC played a large part in the bounce for GBP/USD, bond spreads have also moved in favour for Cable. As was widely expected, the Fed meeting did little to rock the boat and largely stuck to the script, albeit with some subtle changes. That said,my view remains that some taper excitement can be expected at the next month’s Jackson Hole Symposium, a rather fitting time as it would mark the anniversary of the announcement of average inflation targeting.

GBP/USD Stops Short at Familiar Resistance

Source: Refinitiv

Looking ahead to next week, two stand out data points will grab market participants focus, with the BoE decision on Thursday and NFP on Friday. For the Bank of England, policy changes are not expected, however, with a split between the doves and hawks beginning to emerge on the committee, this will increase the focus on the accompanying statement and economic projections. Given Delta variant risks are subsiding thanks to a successful vaccination program, the BoE may start to show more signs of optimism and thus underpin the currency. Elsewhere, with Fed tapering of QE a near certainty, the focus is instead on the timing of when the announcement will come and in turn this is where the NFP data will be key.

Source: DailyFX

GBP/USD: The pair has stopped short at familiar resistance once again, however, with GBP back above 1.3900, dips look likely to find support ahead of the BoE decision. However, a close above 1.4000 will be needed to reinforce bulls.

EUR/GBP: The psychological 0.8500 handle handle remains formidable, although, downside pressure is likely to persist with a break opening the doors to 0.8470-80. Fading rallies from 0.8600 is the preferred view.

EUR/GBP Chart: Daily Time Frame

Source: Refinitiv

“The Need to Know Complete Guide on Trading the Pound (GBP)”

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |