Fundamental Forecast for GBP: Neutral

- Deluge of data to dictate near-term British Pounddirection via August rate hike odds.

- Brexit uncertainty likely to see increased risk premium amid parliamentary vote.

- Retail traders continue to buy the British Pound, which leads to a contrarian sell signal for the time being.

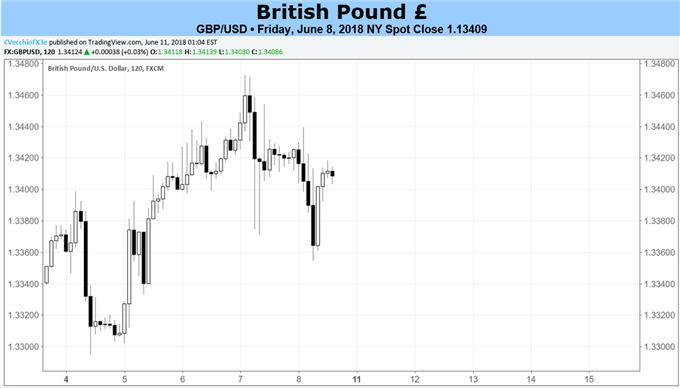

The recovery in GBP had been mired by the increased concerns surrounding Brexit over the past week with PM May conceding to threats made by Brexit Minister Davis to quit if an Irish backstop was left open-ended. As such, GBPUSD failed to make a firm break above 1.3400, reaching lows in the mid-1.33s. Looking ahead towards next week, the near-term outlook for GBP will not only be dictated by the latest developments on the Brexit front but also by the deluge of UK data, subsequently we have a neutral view for GBP.

The upcoming week will see a plethora of key economic releases from the UK. The latest employment report is scheduled for Tuesday where wage growth (ex-bonus) is expected to stand at 2.9% with weekly earnings remaining at 2.6%. A beat on the wage components will likely provide further ammo for the BoE hawks, advocating the case for a rate hike at the August QIR meeting and consequently bullish for the Pound. The hawkish tilt in the rhetoric from BoE members over the past week briefly kept the Pound firm with GBP/USD reaching a 2-week high at 1.3472.

On Tuesday, June 12, Theresa May’s Brexit plan will face its most severe test to date as she asks her divided party to overturn changes made the EU Withdraw Bill. The largest issue centre’s around issue of whether the UK should leave the Customs Union, which PM May wants, however some members of her party prefer to stay aligned with the EU’s border regime. Subsequently, defeat in upper parliament will keep the pressure on GBP amid an increase in risk premium.

On Wednesday, inflation figures will be reported, whereby the headline rate is seen rising 0.1ppt to 2.5%, while the core figure is expected to stay at 2.1%. There is potential for an upside surprise in the headline reading amid the surge in energy prices, as such this would likely see GBP push higher, given that inflation will move further away from the BoE’s remit. Reminder, BoE’s Ramsden stated last week that rate hikes will be warranted if inflation is persistently above 2% target.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX