Gold Price Fundamental Forecast: Bearish

- Gold prices’ inverse link to the US Dollar has strengthened recently

- US econ. data may underperform, fueling risk aversion as gold sinks

- Hazards for the yellow metal also include more dovish RBA, Brexit

Looking for a technical perspective on the Gold? Check out the Weekly Gold Technical Forecast.

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

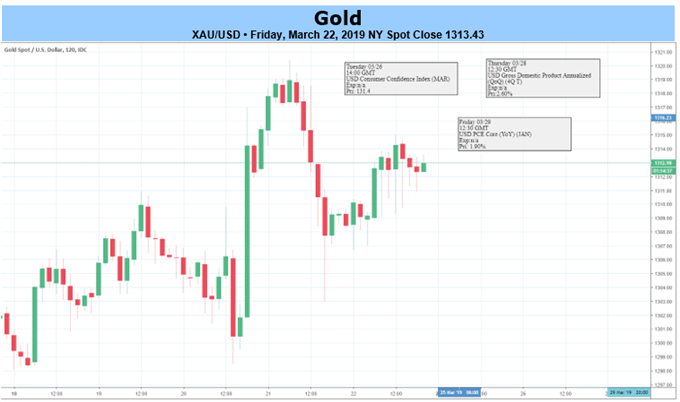

Gold prices spent most of last week declining, with the commodity dropping almost 1.5 percent in its worst single-day performance since the beginning of March on Thursday. The anti-fiat precious metal, thanks to a lack of interest-bearing qualities, inversely tracked the US Dollar. At one point, it even weakened alongside a pullback in the S&P 500. This undermined its often-associated trait as a safe haven.

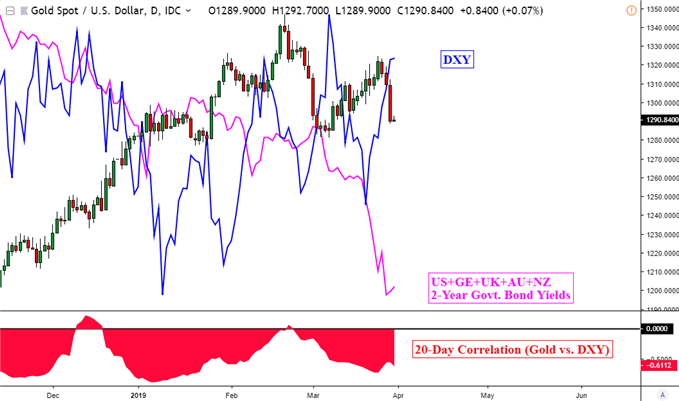

Lately, XAU/USD has been tending to be more sensitive to movements in the Greenback. Looking at the chart below, the yellow metal fell despite a deterioration in front-end government bond yields from developed countries such as the United States and Germany. Simultaneously, its correlation with DXY has been becoming increasingly inverse since the end of February.

Gold Versus Developed Nation 2-Year Government Bond Yields and US Dollar

Chart Created in TradingView

Gold Week Ahead

With that in mind, gold prices will be closely watching what could impact the US Dollar in the week ahead, and there is much to anticipate. Ahead, data such as US retail sales, durable goods and the latest non-farm payrolls report are on the docket. The Federal Reserve is currently in wait-and-see mode as it cooled expectations of two hikes for this year. Can those odds be revived?

The Citi surprise index seems to suggest otherwise. Data has been tending to increasingly underperform in the world’s-largest economy, hinting that more downside surprises could be in store ahead. This was largely the case this past week. It should be noted that Fed funds futures are pricing in about a 70% chance of a hike for this year. Yet, the US Dollar has held up remarkably well all things considered.

If US equities suffer on fears of economic growth slowing on dismal domestic economic statistics, the Greenback may receive a lift. Aggressive risk aversion often diverts investors into the world’s most liquid asset. Another source of uncertainty could come from the RBA given that the RBNZ recently announced that it favors a cut as its next move. If the former follows suit, USD could rally, pressuring the metal.

Gold may move inversely to USD, but the direction of government bond yields should still be taken into account. Let’s not forget that gold’s rise since the latter half of 2018 tracked a flattening in a closely-watched section of the US yield curve before it eventually inverted on March 22. Brexit also remains a wildcard for sentiment. Given these numerous risks, gold bulls ought to proceed with caution.

Gold Trading Resources:

- See our free guide to learn what are the long-term forces driving gold prices

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Other Weekly Fundamental Forecast:

Crude Oil Forecast – Crude Oil May be Overextended, But Watch Out For Trade Headlines

British Pound Forecast – GBP/USD Rate Threatens Bull Trend Ahead of Brexit Deadline

US Dollar Forecast – US Dollar May Rise as Sentiment Succumbs to Potent Headwinds