Asia Pacific Market Open Talking Points

- British Pound dives as the UK Parliament finds no consensus on Brexit alternatives

- Gold prices decline as risk aversion on growth fears fuel demand for US Dollar

- Asia Pacific equities may fall, boosting the Japanese Yen as AUD and NZD drop

Find out what the #1 mistake that traders make is and how you can fix it!

GBP/USD Falls as UK Parliament Finds No Majority on Brexit Options

In a surprising turn of events, the British Pound aggressively declined after UK’s Parliament was unable to find a majority consensus for an alternative Brexit plan to Prime Minister Theresa May’s deal. The top choice was "motion M" which had 268 votes for it while being rejected by 295. This would have required a confirmatory public vote on any deal.

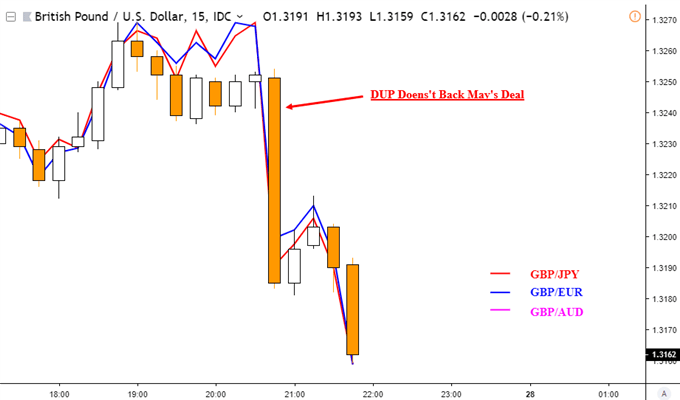

In second place was "motion J" by 264 to 272, which would involve negotiating a permanent customs union with the EU. Earlier in the day, and in an attempt to build support for her twice-rejected EU-UK divorce plan, the Prime Minister offered to resign should her deal gather enough support. But hours later, the Democratic Unionist Party remained opposed to her withdrawal agreement. That was when Sterling started to slip (see chart below).

British Pound Reaction to Latest Brexit News

Chart Created in TradingView

Other Major FX Developments

The anti-risk Japanese Yen, Swiss Franc and to a certain extent the US Dollar traded mostly higher on Wednesday. That is because sentiment deteriorated, particularly during the Wall Street trading session as bond yields tumbled and the S&P 500 closed 0.46% lower. Anti-fiat gold prices declined, owing to a stronger Greenback which undermined the metal’s status as a safe haven as anticipated.

Thursday’s Asia Pacific Trading Session

Global slowdown fears seem to be a lingering threat for market mood, with the Reserve Bank of New Zealand recently alluding to greater chances of a rate cut ahead. The latest trade report from the US showed that while exports picked up slightly from December, the overall trajectory for outward shipments has been slowing since May. This may indicate fading external demand.

With Brexit seemingly in limbo, the fundamental conditions for risk appetite are arguably worsening. S&P 500 futures are pointing cautiously lower, suggesting that Asia Pacific benchmark stock indexes may trade lower. If this is the case, the Japanese Yen could have more room to gain ground against its major counterparts. This would come at the expense of sentiment-linked currencies such as AUD and NZD.

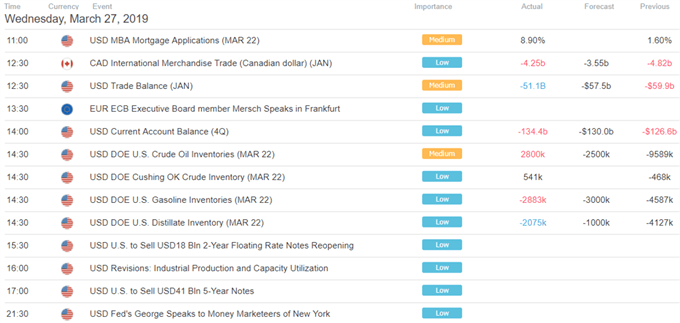

US Trading Session Economic Events

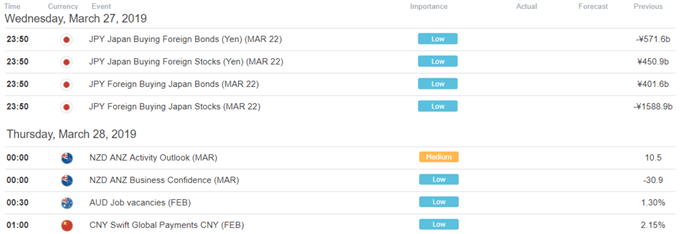

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter