NZD/USD Tumbles on More Dovish RBNZ

- New Zealand Dollar tumbles as RBNZ hints rate cut bias

- This echoes similar cautious commentary from Fed, ECB

- NZD/USD may have more room to fall on technical signs

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

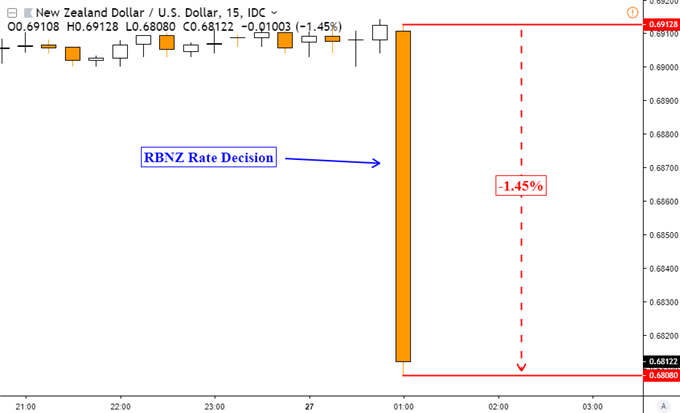

The New Zealand Dollar declined as much as 1.45%, setting itself up for the worst performance in a single day since February 6th on amore dovish RBNZ rate decision – even though the shift in sentiment was expected. Holding rates unchanged at 1.75% was the widely-anticipated outcome, but the surprising portion was that the central bank’s shift to an outlook that favors a rate cut over a hike.

The Reserve Bank of New Zealand expressed that the risks to the outlook have shifted to the downside, following similar downgrades from its largest central bank counterparts. Most recent was last week’s dovish Fed, which essentially took hikes (2) off the table for this year. The concerns from the RBNZ were straight forward: weaker global growth, reduced domestic momentum and low business sentiment.

The RBNZ’s cautious transition was not taken terribly well in equities. The Nikkei 225 aimed lower on the announcement, down about 0.75% at the time of this writing. Meanwhile, the anti-risk Japanese Yen, and to a certain extent the US Dollar, both rallied. Simultaneously, the pro-risk Australian Dollar edged cautiously lower.

Ahead, the pro-risk currency will be closely eyeing market optimism which could be dictated by key US economic news flow. The remainder of the week offers US GDP and Core PCE data which threatens to fall short of economists’ expectations. This has been the tendency as of late, with disappointing consumer confidence over the past 24 hours being the most recent example. Technical signs hint of a turn lower in the S&P 500 as well.

NZD/USD 15-Minute Chart Reaction to RBNZ

Chart Created in TradingView

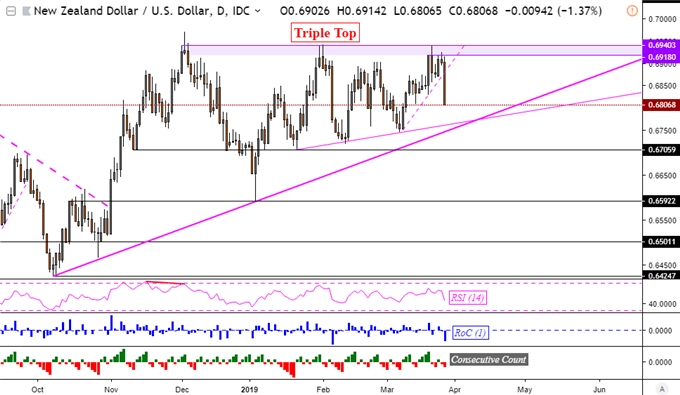

NZD/USD Technical Analysis

NZD/USD cleared a near-term rising support line from the beginning of this month after failing to clear a range of resistance beyond 0.6918. Looking at the daily chart below, you can see a triple top formation. If the pair manages to fall under the rising trend line from October, there may be more room for losses ahead. You can follow me on Twitter for the latest updates on NZD here at @ddubrovskyFX.

NZD/USD Daily Chart

Chart Created in TradingView

New Zealand Dollar Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter