Fundamental Australian Dollar Forecast: Bearish

- AUD/USD has gained on hopes the world’s financial authorities are equal to the massive challenge of coronavirus

- However it may be that some doubts on this score are setting in

- The currency could slip back if they get much deeper

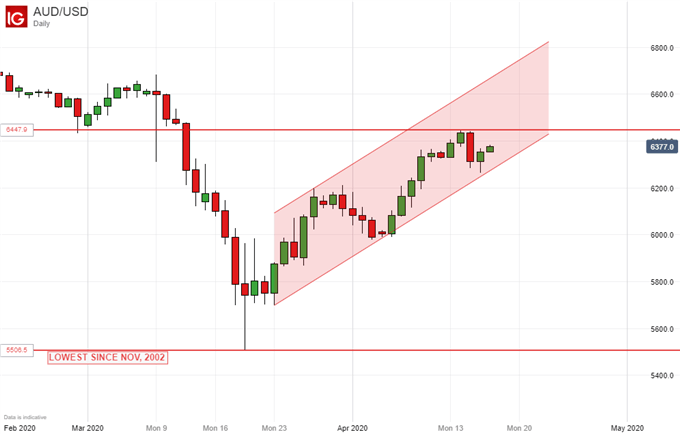

The Australian Dollar has risen sharply through April, benefitting as have many other growth-correlated assets from the astonishing rescue packages launched around the world in an effort to cushion economies from the coronavirus’ effects.

And yes, billions of dollars’ worth of extra liquidity is now ready to flood markets, very possibly, turbo-charging recovery. When it comes. However, it hasn’t come yet and most national economies remain in varying states of lockdown while the contagion continues to spread and forecasts of global recession spread almost as fast.

Has Optimism Been Overdone?

There are now signs of market fear that they may have overdone the optimism and, if they take deeper root, progress could be tough for the Aussie.

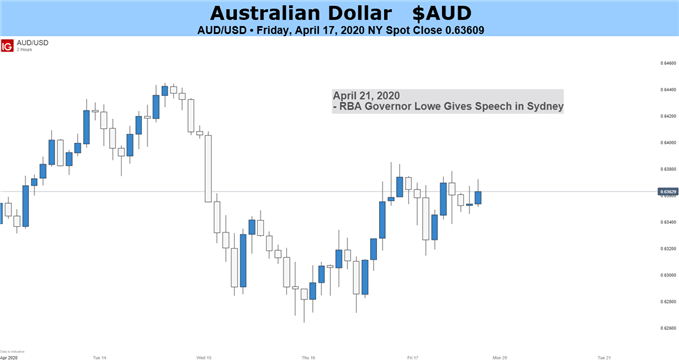

There’s not a huge amount on the domestic data slate likely to deter investors from their broad focus on the coronavirus headlines worldwide. Tuesday will bring a look at the minutes of the last monetary policy meeting of the Reserve Bank of Australia which took place on April 7. Interest rates were held at their record lows back then, to the surprise of markets which had just about expected a further reduction to go with the two quarter-point trims made in March.

However, it seems likely that the minutes will do no more than make it clear that all stimulus options remain on the table, and that will not add anything to what the market must already know. Investors will also get a look at the ‘trimmed mean’ quarterly inflation numbers, a curtain raiser for the full official release which will come toward the end of the month. Stickily low inflation was a key barrier to higher interest rates in the pre-Covid days but, as rates are likely to remain constrained for some time in any case now, the numbers may lose a bit of their bite.

Skilled vacancy data for March could attract more attention than usual given that official jobless data for the month held up astonishingly well. It’s likely that this merely reflects a survey period which expired before virus-linked travel bans and shutdowns were imposed, but the labor market is in special focus now.

Barring some unpredictable bit of left-field good news it seems likely that the Australian Dollar could struggle this week, so it’s another bearish call.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

Australian Dollar Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!