Fundamental Australian Dollar Forecast: Neutral

- The Reserve Bank of Australia is not expected to pull the interest rate trigger yet

- Growth looks certain to be anemic, the question is to what extent

- Trade, recession worries may continue to drive

Find out what retail foreign exchange traders make of the Australian Dollar’s prospects right now, in real time, at the DailyFX Sentiment Page

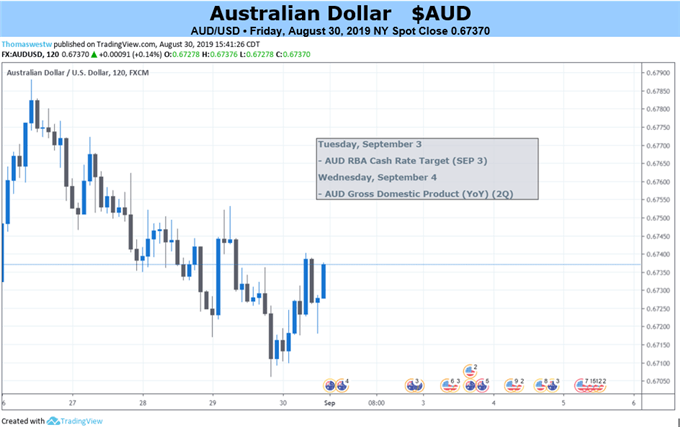

The Australian Dollar faces a busy week for domestic economic news but may require significant deviations from market forecasts if they’re to tear the currency out of overall risk appetite’s grip.

The Reserve Bank of Australia will give its September monetary policy verdict on Tuesday. Markets expect that the record-low 1% Official Cash Rate will be staying put. That probability is around 90%, according to index provider ASX. Futures markets still reckon we’ll see two more quarter-point reductions over the next six months, but they don’t price in the first of them until November.

Assuming the RBA keeps its hands of the monetary levers this week, what it may say in any statement will be important. In recent months these tended to emphasize both the long-term nature of historically low interest rates and the benefits of a weaker Australian Dollar in the RBA’ long fight against weak inflation. More of the same is unlikely to offer the currency much respite.

GDP Prospects Look Mixed at Best

Wednesday will bring a first look at official second-quarter Gross Domestic Product data. Here things are very much in the balance. Business investment has already been shown to have sagged in that period but spending on plant, equipment and machinery remains robust in corporate Australia. There has been a marked slowdown in overall construction activity, however, which is bound to make its presence felt in the numbers.

The markets is looking for quarterly expansion of between 0.2% and 0.5%, after the first quarter’s insipid 0.4% rise. Assuming no surprises an outcome within that range may pass the market by. After all the second quarter is long behind us and investors may see far more pressing current risks in the form of global trade and recession fears.

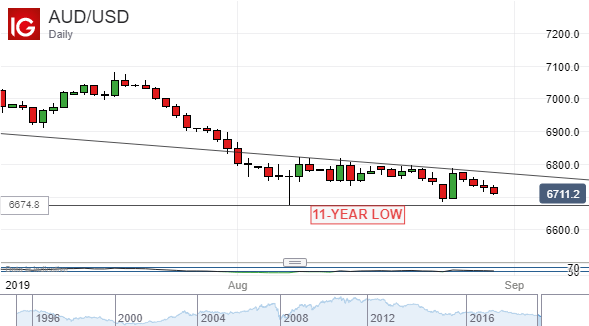

As a new week begins there seems to be some relative optimism that China and the US will keep talking on trade. However, this optimism is fickle, utterly subject to news flow. Should it endure the Australian Dollar can expect support but there’s little reason to suppose that a meaningful recovery is coming for this most growth-sensitive currency.

It’s a cautious neutral call this week.

Australian Dollar Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!