Fundamental Australian Dollar Forecast: Bearish

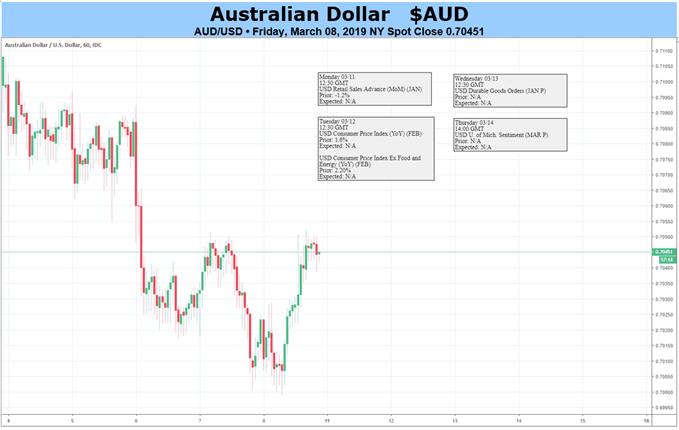

- AUD/USD is looking again at its lows for 2019

- If they give way, much more significant lows will beckon

- A lack of domestic news may buy the Aussie some time, but the direction of travel is clear enough

Find out what retail foreign exchange traders make of the Australian Dollar’s prospects right now, in real time, at the DailyFX Sentiment Page

Australian Dollar bulls endured another punishing week in which the currency traded down to lows not seen since early January.

There were many catalysts for this, but the strongest was unarguably a very weak Gross Domestic Product release out of the Aussie’s home country. The 0.2% on-quarter growth logged in the final three months of 2018 was the weakest print since the third quarter of 2016. It was below market expectations, too.

AUD/USD has been defensive for some time, not helped by last month’s comprehensive hack at growth and inflation forecasts by the Reserve Bank of Australia. The GDP only made things worse.

The bottom line is that Australia’s record low Official Cash Rate of 1.50% will be with us for some time yet (and it’s already more than two years old). Indeed, futures markets now price in a further reduction by the end of this year. Expectations in this direction have been getting sharper and more urgent since the final months of 2018.

There is no domestic economic data on tap in the coming week which is likely to make any permanent dent in this forecast.

We will get snapshots of both business and consumer confidence, along with a look at inflation expectations. However, while any or all of these could mean short-term AUD/USD fluctuations, none will alter the basic fact that the Australian Dollar completely lacks monetary policy support.

Of course, as the Euro amply demonstrated last week, other currencies are in a similar position when it comes to their own central banks. Moreover, given the dearth of domestic drivers, the Aussie is likely to be especially vulnerable to international goings on.

Even so it is very hard to get very bullish. After all, this year’s lows guard the way to nadirs unseen since 2009.

Looking for a technical perspective on the Australian Dollar? Check out the Weekly AUD Technical Forecast.

There remains the looming risk of a trade settlement between the US and China. That may or may not prove the silver bullet for global economic woes that some seem to think it is. But it would certainly give markets a short-term boost, perhaps a significant one. As a key partner of both Washington and Beijing, Australia and its currency stand to benefit here.

However, on balance no news is unlikely to be good news for the Australian Dollar in its current mood, so it’s a bearish call from me.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!