Fundamental Australian Dollar Forecast: Bearish

- AUD/USD steadied last week

- However, it still lacks interest rate support and markets won’t forget that

- The RBA is unlikely to let them

Find out what retail foreign exchange traders make of the Australian Dollar’s prospects right now, in real time, at the DailyFX Sentiment Page

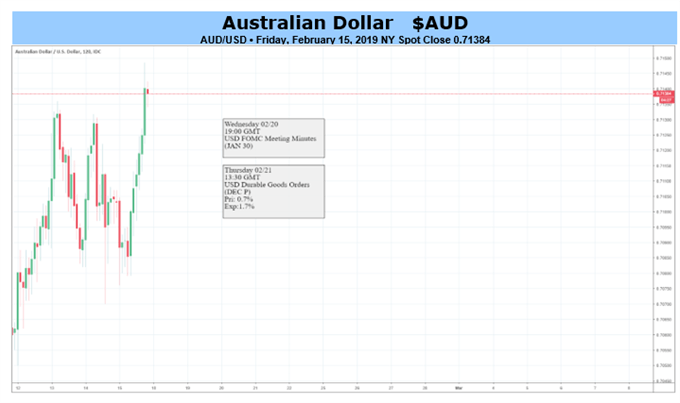

The Australian Dollar enjoyed a more tranquil week last week, with little movement in AUD/USD seen compared to the previous one. However, the currency remains markedly caught between competing forces, with those dragging it lower likely to prevail in the coming sessions.

The Aussie has already been hit this month by a series of apparent mind-changes over at the Reserve Bank of Australia. On February 6 the RBA suggested that the record-low, 1.50% Official Cash Rate could yet fall further. Previously it had proclaimed itself pretty sure that the next move would be a riser. The currency was still reeling from that hit when the RBA went further and slashed its own growth and inflation forecasts.

The markets clearly decided that AUD/USD had suffered enough for the moment after the battering it got from that double whammy. Moreover, hopes for a US/China trade accord kept overall risk appetite up for much of last week. That’s the sort of thing which usually cheers Aussie bulls and, sure enough, AUD/USD remains just above the downtrend channel which dominated 2018’s trade.

The coming week will bring plentiful Australian economic news, most notably on the employment front where job-creation has long been strong. Purchasing Managers Indexes are also coming up. However, the end of the week will bring parliamentary testimony from RBA Governor Philip Lowe. This will bear watching.

There haven’t been many RBA appearances since that change of guidance. One member we have heard from is Assistant Governor Christopher Kent. Speaking last Friday, he was quick to highlight the benefits of a weaker currency to the Australian economy, especially on the inflation fighting front.

If Mr. Lowe strikes a similar note this week, as he probably will, the Aussie may well retreat again. So it’s a bearish call.

Looking for a technical perspective on the AUD? Check out the Weekly AUD Technical Forecast.

Australian Dollar Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!