Euro, Swiss Franc, Dax, EUR/CHF Analysis – Talking Points

- Euro could fall vs Swiss Franc if Eurozone Finance Ministers’ outlook undermines sentiment

- DAX losses may be amplified in market-wide selloff in equities amid coronavirus contagion

- Financial markets panicked after Fed cut rates to zero and deployed $700 billion QE program

ASIA-PACIFIC RECAP: FED CUTS RATES TO ZERO, RBNZ SLASHES OCR TO ALL-TIME LOW

The Japanese Yen surged against its G10 counterparts – but particularly vs the New Zealand Dollar – after the RBNZ slashed interest rates by 75 bps, brining the OCR to a record-low at 0.25%. However, this was overshadowed by the Fed’s unexpected $700 billion stimulus alongside slashing the Federal funds rate to 0.00-0.25 percent.

The Australian Dollar and petroleum-linked Norwegian Krone were also in bad shape as the market-wide selloff in global equities continue to dampen the appeal of risk-oriented assets. AUD was also hit by an announcement from the Reserve Bank of Australia that outlined the central bank’s readiness to conduct government bond purchases as part of a stimulus package to counter the impact of the coronavirus.

Eurozone Finance Ministers Meeting

The Euro may extend its decline vs the Swiss Franc if commentary from Eurozone finance ministers on how to support the economy in light of the coronavirus pandemic spooks markets. Investors may start pouring capital into the region’s standby anti-risk currency – CHF – and away from the Euro as the pair continues to trade at five-year lows (see EUR/CHF analysis below).

The ECB recently expanded its asset-purchasing program in an effort counter the economic impact of Covid-19, but it is unclear as to how effective additional stimulus will be in an already-accommodative environment. Furthermore, investors may also be concerned about the amount of room member states have in deploying fiscal stimulus since regulatory parameters constrict their ability to spend as much as they would like.

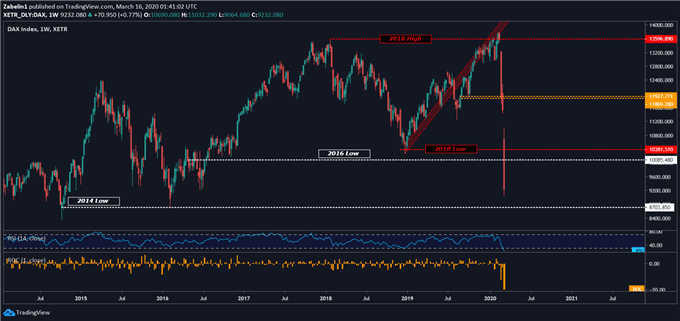

DAX Price Chart

The German DAX equity index has plummeted over 30 percent and is now trading at 2016-lows after erased four years’ worth of gains in just under three weeks. It may now look to test six-year low support at 8730.850. If broken, this could amplify bearish sentiment and lead to further losses of unprecedented magnitude as markets continue to be embroiled in financial turmoil from the coronavirus.

DAX – Daily Chart

DAX chart created using TradingView

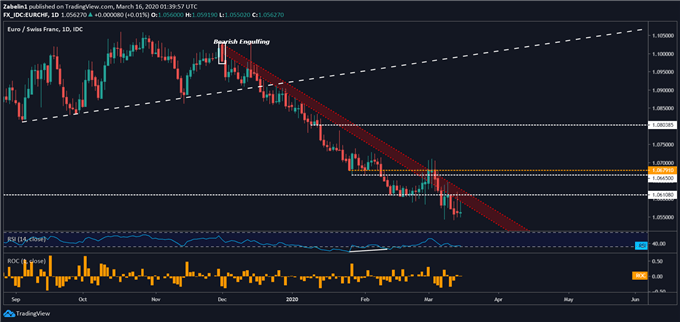

EUR/CHF Analysis

The Swiss Franc may continue to gain against the Euro as the pair trades below descending support dating back to the Bearish Engulfing on December 2, 2019. In addition to trading at five-year lows, EUR/CHF is less than five percent away from trading at its lowest point since the Swiss National Bank removed the floor on the exchange rate in January 2015.

EUR/CHF – Daily Chart

EUR/CHF chart created using TradingView

EURO TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter