Euro, US Dollar, US Consumer Confidence, EUR/USD – Talking Points

- Euro could fall vs US Dollar if consumer confidence data cools Fed rate cut bets

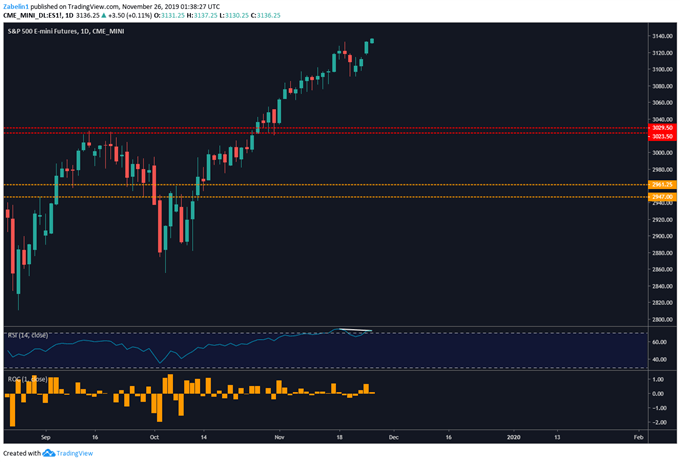

- Market optimism has pushed US stock markets to record-breaking all-time highs

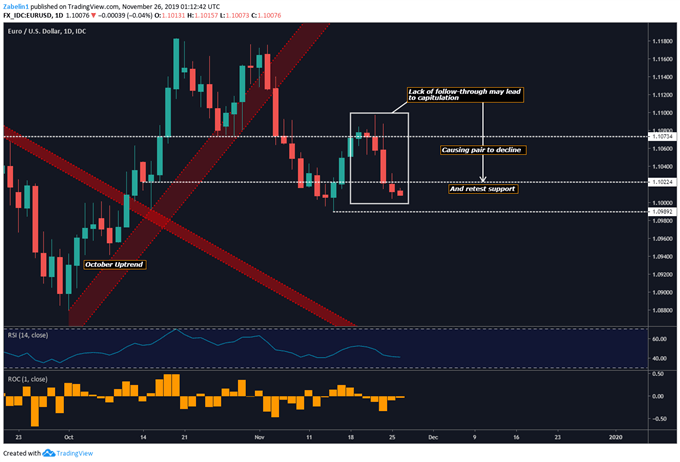

- EUR/USD has broken through 1.1022 and is now eyeing November 14 swing-low

Learn how to use politicalrisk analysis in your trading strategy !

Asia-Pacific Recap

Asian stocks edged modestly higher following a rosy session during Wall Street’s trading hours as equity indices in the US registered another all-time high. Early into Tuesday’s Asia session, Fed Chairman Jerome Powell delivered a speech and reiterated that policy is appropriate as is but followed with a comment of assurance: the central bank will adjust rates if downside risks materially alter the outlook.

EUR/USD Turns to US Consumer Confidence

EUR/USD’s decline may accelerate if US consumer confidence data registers a better-than-expected reading. A sign of improvement in sentiment out of the largest economy in the world comes as US stock markets break all-time highs amid renewed optimism about the outlook on US-China trade talks. However, the question is how long can this buoyancy keep equities and consumer optimism afloat?

S&P 500 – Daily Chart

S&P 500 chart created using TradingView

70 percent of the US economy is driven by spending, so naturally a more confident consumer provides the necessary behavioral foundation to support a consumption-based economy. If sentiment data fails to meet the market’s expectations, it could cause Fed rate cut bets to swell and pressure the US Dollar. However, given the current environment, consumer confidence may strike a more optimistic note and lead to a stronger USD.

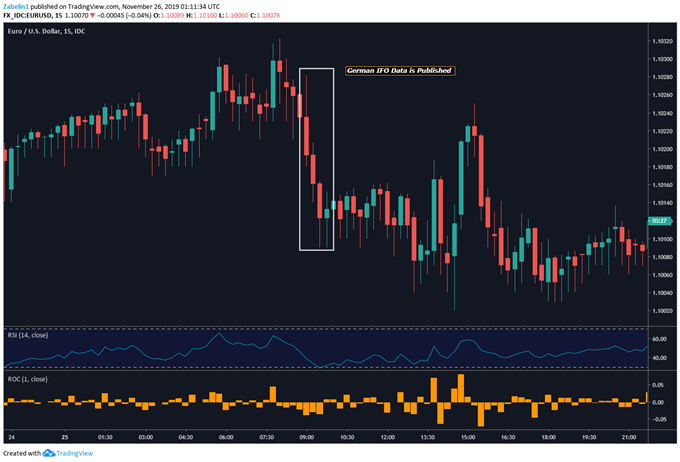

EUR/USD Recent Price Action

EUR/USD edged lower after German IFO business data was published and showed a soured expectations outlook. While the other two subcategories within the report came in as forecasted, it gave traders no reason to rejoice. This is because IFO data – and broadly speaking, a lot of German reports – are hovering at levels not tested since the Eurozone debt crisis.

EUR-USD – 15-minute Chart

EUR/USD chart created using TradingView

EUR/USD Technical Analysis

As forecasted, EUR/USD broke below the 1.1022 support level and was followed by a daily close. The pair may now be readying to test the November 14 swing-low at 1.0989. If the pair also break below this floor with confirmation, it could precede an aggressive selloff and further undo some of the upside progress the pair has made prior to the break of the October uptrend.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter