JAMES BULLARD, GERMAN FACTORY ORDER DATA, US DOLLAR – TALKING POINTS

- US Dollar may rise if Fed’s James Bullard comes off as less-dovish than market expectations

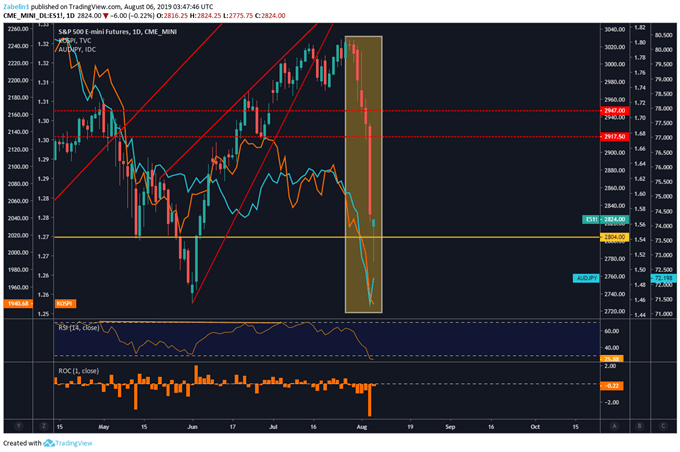

- US-China trade tensions lead to massive selloff in US equities and echoed into APAC session

- German factory order data and Italian politics may spook European financial markets, Euro

See our free guide to learn how to use economic news in your trading strategy !

APAC RECAP

Asia Pacific markets had a rough start to their day after pain in Wall Street from a spike in US-China trade tensions echoed into APAC equities. South Korea’s benchmark Kospi stock index gapped lower and reached a 2-year low with Australian 10-year bond yields reaching their lowest point to date. NZD gained after better-than-expected jobs data crossed the wires. AUDUSD violently oscillated before settling modestly higher after the RBA announced it will be holding the OCR unchanged at 1.00 percent.

What policy measures will China leverage in trade negotiations with the US?

WILL COMMENTARY FROM JAMES BULLARD PRESSURE USD?

The US Dollar may wobble between commentary from St. Louis Fed President James B. Bullard – whom the markets perceive as dovish – and weak German factory order data and perilous Italian politics. The FOMC board member will be speaking at event in Washington on the outlook of the US economy. The Fed’s most recent policy decision and commentary suggests the central bank remains neutral.

A notable moment of significance in regard to how his comments impact financial markets was when he said a 50 basis-point cut would be “overdone”. The US Dollar subsequently rose at the expense of the S&P 500. However, given that market expectations are tilting more dovish than what the Fed conveyed at the most recent policy meeting, it is likely that Mr. Bullard will fall short of investors’ dovish benchmark. The subsequent reaction may result in a strong US Dollar and greater downward pressure on equity markets.

GERMAN FACTORY ORDERS, ITALIAN POLITICS MAY SPOOK EUROPEAN MARKETS

German factory order data may fall short of expectations as the European economy and the regional “steam engine” continue to show weakness. Deteriorating US-China trade relations continue to pressure the European economy. Italian politics may also make their debut and spark volatility in financial markets if parties within the coalition government continue to spar and trigger a possible snap election.

CHART OF THE DAY: S&P 500 Futures, AUDJPY, Kospi Index Aim Lower as US-China Trade War Risks Escalate

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter