Gold Price Talking Points:

- After a strong breakout this summer, Gold prices have now spent almost six months digesting.

- FOMC is on the calendar tomorrow, and the US Dollar is in a precarious spot that can see the currency break in either direction, as highlighted in yesterday’s analyst pick.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

This summer’s price action was emblematic of what can happen in a Central Bank-driven risk-on environment. With the prospect of continued fiat debasement, brought upon by an artillery of stimulus designed to offset the coronavirus pandemic, investors hurried into non-fiat assets like Gold and Silver at a record pace.

Overbought conditions populated Gold markets for a chunk of last summer, but that seemed to matter little in early-August as the yellow metal jumped up to a fresh all-time-high at $2,075. But that same day Gold prices put in a bearish engulfing formation, and as warned in the technical forecast that week, that could open the door to a pullback scenario from those longer-term overbought conditions.

Now, here we are almost six months later, and buyers still haven’t been able to re-take control of Gold prices. Instead, we remain in a round of digestion that’s so far showing no signs of letting up. Meanwhile, similar themes of strength from what Gold showed last summer have popped up in Bitcoin and then Ethereum and, now, in the stock of Gamestop (GME). These bulls markets would all seem symptomatic of a very loose monetary environment, and this is something that we’ll hear the Fed speak on at their rate decision/press conference tomorrow.

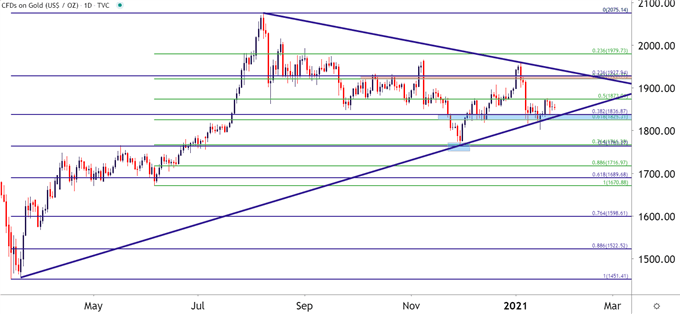

At this point, Gold prices are still in digestion, holding within a longer-term symmetrical triangle pattern.

To learn more about symmetrical triangles, check out DailyFX Education

Gold Price – Daily Chart

Chart prepared by James Stanley; Gold on Tradingview

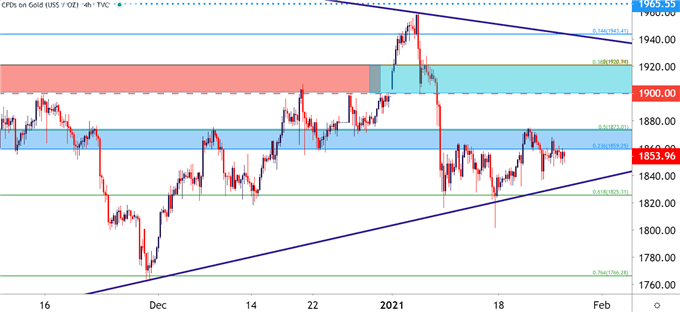

Getting shorter-term on the matter and there’s perhaps even less clarity. There has been some adherence to the Fibonacci retracement levels set by the June-August major move. The 61.8% marker from that study at 1825.31 has now caught a couple of support inflections; while the 50% marker of that move is the topside of a resistance zone that’s currently helping to hold the highs (represented by a blue box on the below chart).

Gold Four-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

Gold Price Strategy Near-Term

Given the case of longer-term digestion remaining on the chart, traders essentially have two possible ways forward: Either play between the cracks or look for the ‘big break.’ Given this week’s economic calendar, along with the slew of earnings releases due from American corporates, and the potential could exist for Gold prices to embark on that next trend, in one direction or the other.

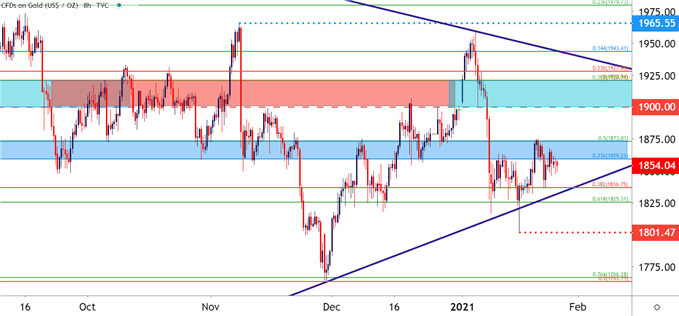

The bearish side of the matter could prove especially challenging after last week’s test below the 1825.31 level. The low of that wick shows just above the 1800-handle, leaving about $25 of uneasy ground on the chart underneath current price action; but this can keep the door open to bearish breakout potential from either the 1825.31 level or the January low of 1801.47. Below that is a confluent zone that remains relevant, as this helped to catch the November swing-low, and this runs from 1763.27 up to 1766.28.

On the topside of price action, there’s another big zone of relevance that runs from 1900-1920, and this could be followed for an ‘r2’ zone should prices test beyond the 1859-1873 zone. Beyond that is another Fibonacci level around 1943.41, after which the current four-month-high comes into play at 1965.55.

Gold Eight-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX