Canadian Dollar, CAD, USD/CAD, Loonie Price Analysis

- USDCAD put in a blistering uptrend in January.

- More recently, the pair has been pulling back, even as USD-strength has run wild.

- Longer-term resistance has held the highs, but shorter-term momentum may have more room to run yet.

USD/CAD Pulls Back After January Jump

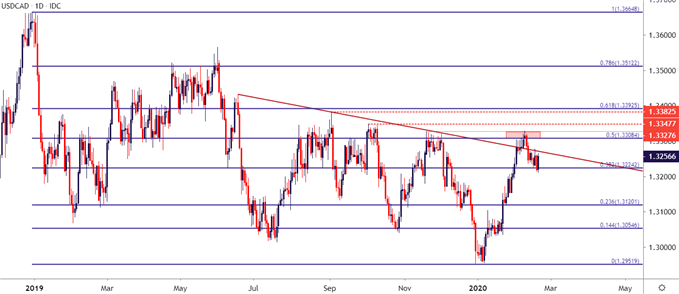

The US Dollar has put in a blistering up-trend in a number of currency pairs, with USD/CAD as a notable recent exception. This isn’t to say the pair doesn’t have some element of a bullish backdrop, as a really strong month of January propelled the pair’s price action up to fresh monthly highs; and even early February saw buyers continue to press the matter, as USD/CAD scaled all the way up for a re-test of the November highs around 1.3325. Since then, however, USD/CAD has been on its back foot, even as USD breakouts are showing in EUR/USD and, more recently, USD/JPY.

At this point, the big question is whether the bullish trend in USD/CAD has more room left to run or whether the pair is now vulnerable to a pullback in the US Dollar. From a longer-term look, bearish swing strategies could be justifiable on the basis of price action running into a thicket of resistance that’s held bulls at bay for the last seven months. Just above current resistance taken from the November highs around 1.3325 is the October high, just inside of the 1.3350 level; and just above that at 1.3383 is the September high. So, there are numerous areas that can continue to help bring bears or swing traders into the matter.

USD/CAD Daily Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

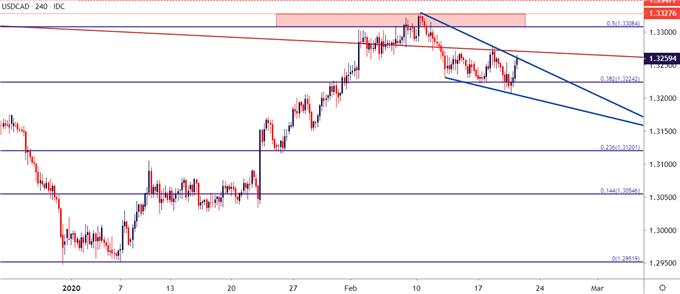

USD/CAD: Shorter-Term May Bring More Bulls into the Mix

The stage may be set for a more aggressive test of those longer-term swing highs; as the shorter-term USD/CAD chart has a number of bullish items that can remain of interest. The pullback in the pair that’s shown over the past week-and-a-half has shown in a rather orderly manner, building in a falling wedge formation which, similar to a bull flag, can be looked to for continuation potential. The falling wedge may have even more bullish allure, owed to the fact that sellers show more vigor around highs than tests of swing-lows; highlighting either a key level of support bringing buyers back into the mix or just a general sense of reticence after prices have fallen.

Another item of interest on that front, price action is building that recent item of support around a key area on the chart; the price of 1.3221 is the 38.2% Fibonacci retracement of the 2018-2019 major move in the pair.

This shorter-term view could look at the recent pullback as a corrective move in what could become a longer-term bullish theme in the pair. Next items of resistance sitting overhead plot around 1.3305, followed by that thicket of resistance swings looked at above: 1.3325, 1.3350, 1.3385.

Also of interest on the bullish side of the equation: Retail traders are aggressively short here, with three traders short for every one that’s long in the observed sample (at the time of this writing, the below indicator is dynamic and will change as sentiment shifts). Given the contrarian nature of retail sentiment, this would point to the potential for further strength in USD/CAD.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX