- USD/CAD holds structured advance- key resistance targets in view at 1.3340 & 1.3375

- Check out our 3Q projections in our Free DailyFX USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The US Dollar has rallied nearly 4% against the Canadian Dollar since the October lows with price now targeting key resistance objectives just higher. These are the updated targets and invalidation levels that matter on the USD/CAD charts heading into the close of the month. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

USD/CAD Daily Price Chart

Technical Outlook: USD/CAD broke above a key resistance pivot at 1.3130/55 early in the month with a subsequent retest as support fueling a rally to fresh four-month highs. The advance has carved out an ascending channel formation extending off the mid-October low and keeps the focus higher in price while above slope support. Key daily resistance objectives are eyed at the yearly high-day close at 1.3340and the confluence zone at 1.3376- both regions of interest for possible exhaustion / short-entries.

Learn how to Trade with Confidence in our Free Trading Guide

USD/CAD 240min Price Chart

Notes: A closer look at price action further highlights the ascending slope series we’ve been tracking with the weekly opening-range lows now converging on channel support at 1.3187- Ultimately a break below 1.3130 would be needed to shift the focus back to the short-side. A breach above the median-line here looks for a stretch towards the upper parallels- I’ll be look for exhaustion there IF reached.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

Bottom line: The immediate risk remains weighted to the topside in USD/CAD but the advance is vulnerable heading into these topside levels. From a trading standpoint, look to reduce long exposure / raise protective stops on a move towards 1.3340. We’ll be on the lookout for a reaction on stretch higher for possible short-entries.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

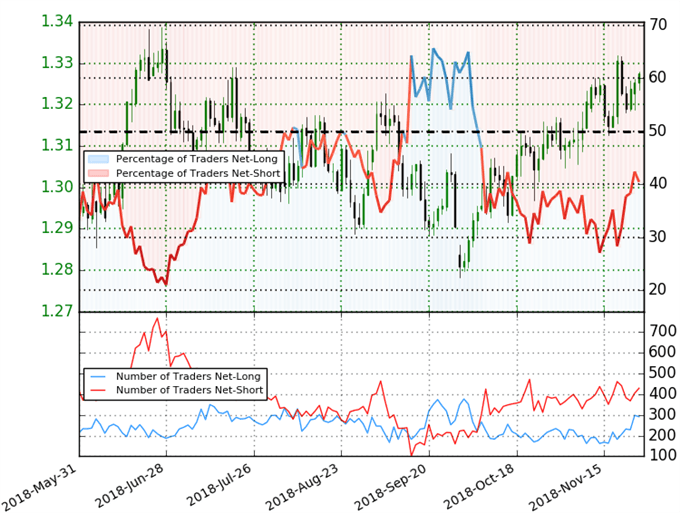

USD/CAD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-short USD/CAD - the ratio stands at -1.47 (40.4% of traders are long) – weak bullishreading

- Traders have remained net-short since October 9th; price has moved 3.6% higher since then

- Long positions are7.0% higher than yesterday and 22.8% higher from last week

- Short positions are 7.0% higher than yesterday and 2.1% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week & therecent changes in sentiment warn that the current USD/CAD price trend may soon reverse lower despite the fact traders remain net-short.

See how shifts in USD/CAD retail positioning are impacting trend- Learn more about sentiment!

---

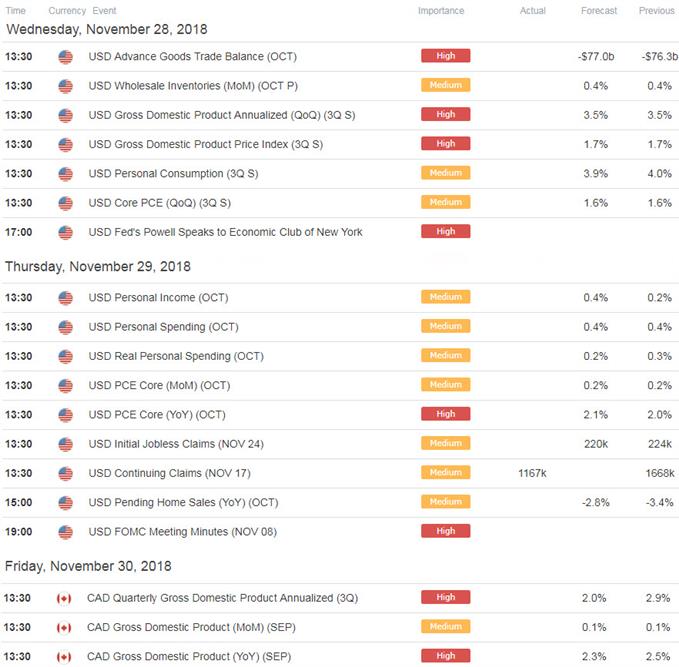

Relevant USD/CAD Data Releases

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide !

Active Trade Setups

- NZD/USD Price Outlook: Pending Bull Flag Breakout in Kiwi

- AUD/USD Outlook: Aussie Searches for Support after Failed Breakout

- Gold Price Outlook: Recovery Finds Resistance at October Trendline

- EUR/USD Price Outlook: Euro Threatens Breakout– Levels to Know

- AUD/JPY Price Outlook: Reversal Run Plummets into Key Support Zone

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com