- GBP/USD tests up-trend support ahead of Bank of England rate decision

- Check out our 2018 GBP/USDquarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

We’ve been tracking a multi-year bullish pitchfork in the Weekly Technical Perspectives over the past few months and the recent Sterling rally failed just ahead of the upper parallel in late-January. The pullback in price is now testing a break below the median-line ahead of Super Thursday when we get the release of the highly anticipated BoE (Bank of England) interest rate decision and quarterly inflation report. Here are the levels to keep I mind for the British Pound.

GBP/USD Daily Price Chart

Technical Outlook: Sterling turned lower on strong bearish divergence last week with the prices attempting to close below confluence support around 1.3943- watch today’s close. Note that a momentum support trigger has broken and further highlights the risk for further losses should price hold at these levels. Interim support now at the 61.8% retracement of the Brexit decline at 1.3843.

Resistance stands at with the monthly open at 1.4189 with a breach above the 78.6% retracement at 1.4356 needed to mark resumption of the broader up-trend targeting the upper parallel backed by the 2016 open at 1.4730.

New to Forex Trading? Get started with this Free Beginners Guide

GBP/USD 120min Price Chart

Notes: A closer look at price action sees the Cable trading within the confines of a descending pitchfork formation with the median-line further highlighting near-term support at 1.3843. Interim resistance stands at 1.3943 with near-term bearish invalidation eyed at the 1.4028/30 confluence zone. A breach there would shift the focus higher towards the weekly open at 1.4111 and the monthly open at 1.4189.

A break of the lows tomorrow would risk a larger setback in the British Pound with such a scenario targeting a critical region of confluence support at 1.3658/84- a region defined by the 2017 swing high, the Brexit gap and the 1.618% extension of the decline.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: IF Sterling breaks down from here, look for a larger correction towards slope support. From a trading standpoint, ultimately a larger set-back near-term would offer more favorable long-entries before resumption of the broader uptrend. For now, as we head into the Super Thursday the immediate focus is on a break of the 1.3843-1.3943 range.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis mini-series

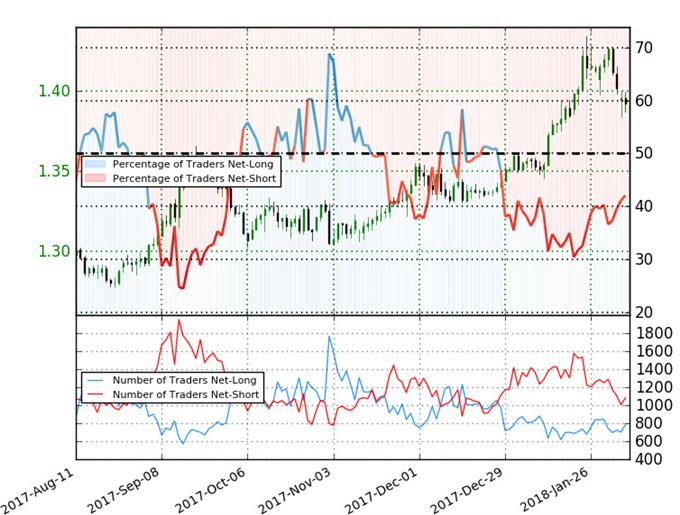

GBP/USD IG Client Sentiment

- A summary of IG Client Sentiment shows traders are net-short GBPUSD- the ratio stands at -1.38 (42.0% of traders are long) – weak bullishreading

- Retail has remained net-long since Dec 28th; price has moved 4.1% higher since then

- Long positions are 4.7% lower than yesterday and 10.5% lower from last week

- Short positions are 0.9% lower than yesterday and 15.3% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. However, retail is more net-short than yesterday but less net-short from last week and the combination of current positioning and recent changes gives us a further mixed GBPUSD trading bias from a sentiment standpoint.

See how shifts in GBP/USD retail positioning are impacting trend- Click here to learn more about sentiment!

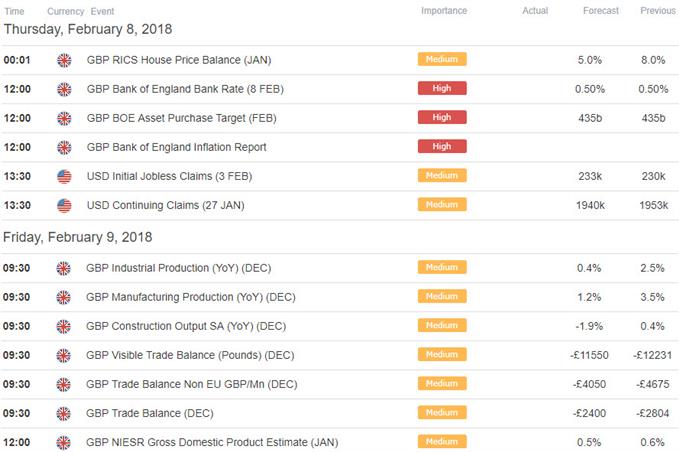

Relevant GBP/USD Data Releases

---

Other Setups in Play

- EUR/USD Down but Not Out as Prices Approach Bullish Trend Support

- The Return of Volatility: Weekly Technical Outlook

- AUD/USD Price Rally Vulnerable Ahead of FOMC, NFP

- Bitcoin Price Breakdown Resumes- Bears Aim for New 2018 Lows

- Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly via email, please SIGN UP HERE

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com