- AUDUSD up 8% since December- Prices eye technical resistance just higher

- Check out our 2018 AUDUSDquarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

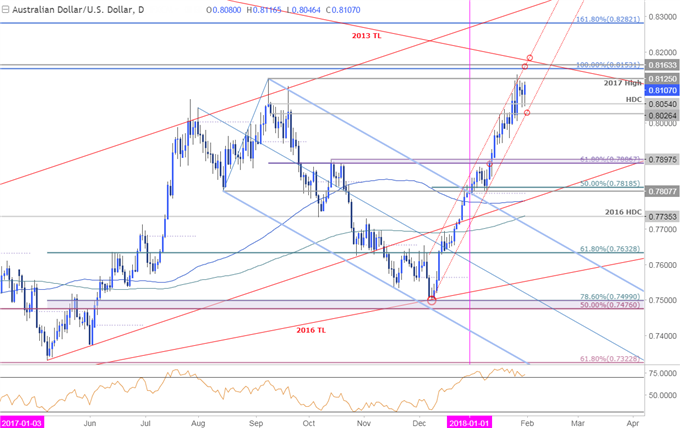

AUD/USD Daily Price Chart

Technical Outlook: Aussie has rallied for the past seven consecutive weeks prices rallying nearly 8% off the December lows. Earlier in the month we noted that, “A breach above the high-day close at 8054 targets channel resistance around ~8100 backed by the 2017 high at 8125 and the 100% extension at 8153. Bottom line: the immediate advance is vulnerable but ultimately a pullback should offer more favorable long-entries.”

Prices stalled briefly before rallying into the 2017 high / channel resistance at 8125. The immediate advance is at risk heading into key resistance at 8153/63 where the late-2015 swing highs converges on the 100% extension of the 2016 advance, with basic trendline resistance off the 2013 highs just higher at around ~8180- both areas of interest for possible near-term exhaustion / short-entries.

New to Forex Trading? Get started with this Free Beginners Guide

AUD/USD 240min Price Chart

Notes: A closer look at price action sees the Australian dollar trading within the confines of a well-defined ascending channel formation extending off the December lows. Price rebounded off channel resistance into the close last week and a clear weekly opening-range is now in focus between 8054-8125.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: while the broader outlook remains weighted to the topside, the advance is vulnerable heading into confluence resistance just higher. From a trading standpoint, I’d favor fading strength into structural resistance with a break below 8026 needed to validate that more significant near-term high is in place- such a scenario targets subsequent support objectives at 7956 and 7886/98. A breach above structural resistance would keep the long-bias in play targeting the 50% retracement at 7515.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis mini-series

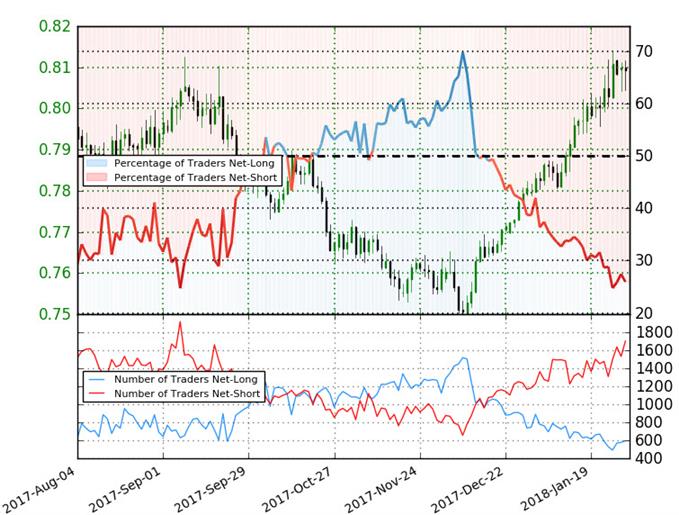

AUD/USD IG Client Sentiment

- A summary of IG Client Sentiment shows traders are net-short AUDUSD- the ratio stands at -2.85 (25.9% of traders are long) – bullishreading

- Retail has remained net-short since Dec 19th; price has moved 7.1% higher since then

- Long positions are 1.5% lower than yesterday and 3.4% lower from last week

- Short positions are 12.5% higher than yesterday and 16.0% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUDUSD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger AUDUSD-bullish contrarian trading bias from a sentiment standpoint.

See how shifts in AUD/USD retail positioning are impacting trend- Click here to learn more about sentiment!

---

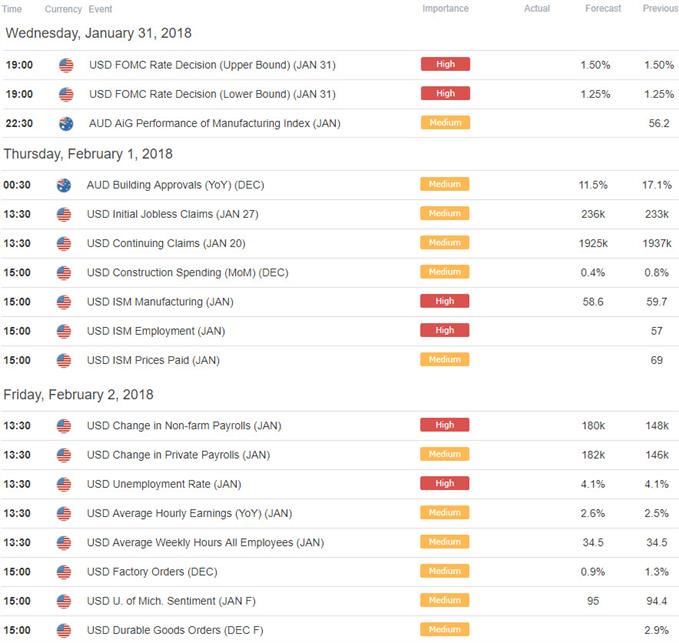

Relevant AUD/USD Data Releases

Other Setups in Play

- Bitcoin Price Breakdown Resumes- Bears Aim for New 2018 Lows

- German DAX Signals Risk for Further Losses

- Weekly Technical Outlook- US Dollar Bears to Face FOMC, NFP

- USD/JPY Plummets to 4-Month Lows; More Pain to Follow?

- AUD/JPY Outlook Hinges on Break of Monthly Opening

- Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly via email, please SIGN UP HERE

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com