- Key technical setups we’re tracking amid the sell-off in risk- monthly opening ranges in focus

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

Will the Market Sell-off Continue?

We’re almost 5% off the highs in the SPX and while we could see some recovery near-term, the technical damage has been done and we’re likely to see lower levels in the days ahead. A quick look at the bond market also highlights upcoming resistance in yields with the 10-year eyeing a long-term slope confluence around 2.90 just higher.

New to Forex? Get Started with this Free Beginners Guide!

An in-depth, multi-timeframe look at the DXY (Dollar Index) alongside the FX Majors heading into the start of the week. Our outlook remains unchanged from last week and, “The price-action analog we’ve been following continues to suggest that a material risk remains for some USD exhaustion (rebound in price) as price approaches structural support just above the 88-handle.” Ultimately we’re looking for fresh lows in the DXY before a more significant turn higher in price.

Key Levels in Focus

DXY – Near-term support still 88.00/27- Resistance at 90

AUD/USD - Key near-term support steady at 7886/94- Bearish invalidation lowered to 8004

AUD/JPY - Risk for a near-term rebound- Rallies should be capped by 88.07IF the broader decline is to remain viable

USD/CAD – Looking for resistance on a stretch into 1.2530s – bearish invalidation now 1.2580/97

Bitcoin (BTC/USD) – Risk remains lower towards support zones at 6519-6790s & 5523-5646 for a near-term low.

For a complete breakdown of Michael’s technical approach, review his Foundations of Technical Analysis mini-series

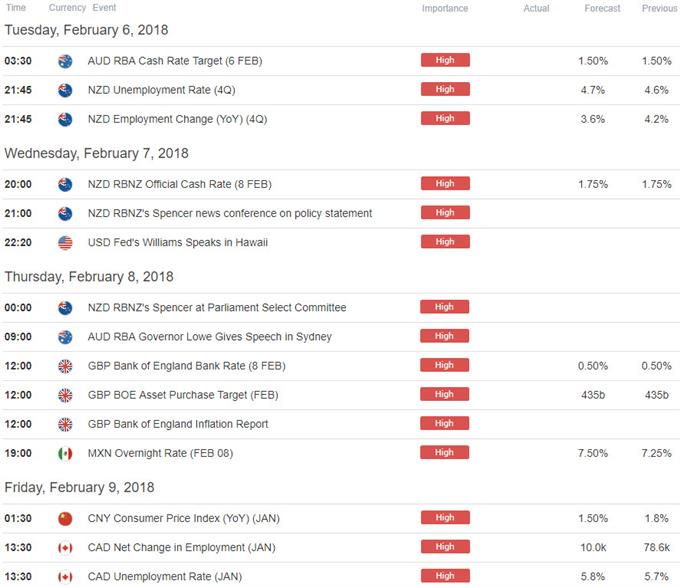

Keep in mind, the February opening ranges are just taking shape with the BoE (Bank of England) interest rate decision and Canada Employment highlighting event risk this week. Updated technical setups discussed on DXY, SPX500, DAX, JPN225 (NIKEI 225), TNX (10yr Yields), AUDUSD, BTC/USD, USD/JPY, USD/CAD, AUD/JPY, GBP/USD, NZD/USD and GBP/NZD.

Key Data Releases

Other Setups in Play:

- USD/CAD Opens February at Support- Rallies to Be Sold

- AUD/USD Price Rally Vulnerable Ahead of FOMC, NFP

- Bitcoin Price Breakdown Resumes- Bears Aim for New 2018 Lows

- German DAX Signals Risk for Further Losses

Why does the average trader lose? Avoid these Mistakes in your trading

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.