To receive Michael’s analysis directly via email, please SIGN UP HERE

- Gold responds to slope support – prices eying yearly highs

- Check out our Gold quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Gold 240min Chart

Technical Outlook: Gold prices have been trading within the confines of a well-defined ascending channel formation with prices rebounding sharply off monthly open support this week at 1268. The immediate advance is vulnerable while below 1293/95- a region defined by the 2017 high-day close & the yearly stretch highs.

That said, the near-term outlook remains weighted o the topside while within this channel with a breach above resistance targeting the upper parallel / May high at 1303 backed by the 78.6% retracement at 1321. Bullish invalidation is now raised to 1274 with a break below the monthly on 1268 needed to shift the broader focus lower.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

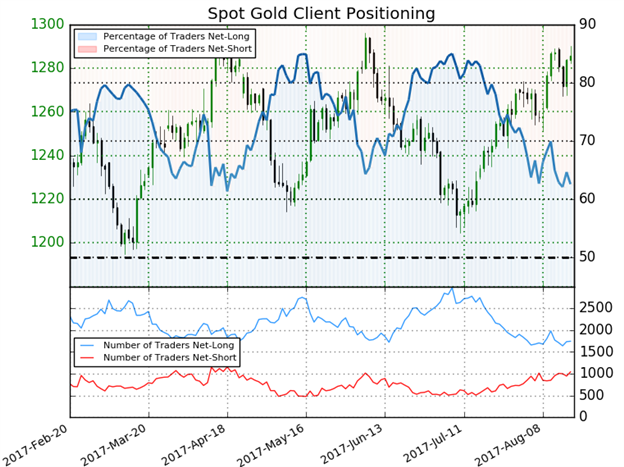

- A summary of IG Client Sentiment shows traders are net-long Gold- the ratio stands at +1.67 (62.6% of traders are long) –bearishreading

- Retail has been net-short since June 4th- Price has moved 5.7% higher since then

- Long positions are 2.2% higher than yesterday but 12.6% lower from last week

- Short positions are 0.2% higher than yesterday and 18.7% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. That said, retail is more net-long than yesterday but less net-long from last week and the combination of current positioning and recent changes gives us a further mixed Gold trading bias form a sentiment standpoint.

See how shifts in Gold retail positioning are impacting trend- Click here to learn more about sentiment!

---

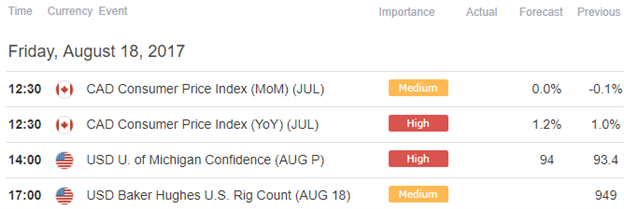

Relevant Data Releases

Other Setups in Play:

- AUD/USD Bull-Flag Breakout in the Works

- GBP/USD Prices Testing Support- Risk for Further Losses Remains

- Strategy Webinar: Dollar Recovery Looks to FOMC Minutes for Fuel

- AUD/JPY Testing Key Support as Risk Aversion Drives Yen

- Ethereum at Risk Near-term as Prices Rally to Fresh Monthly Highs

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.