- AUD/JPY testing support confluence- shorts at risk above 85.45 near-term

- Check out our New 3Q projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

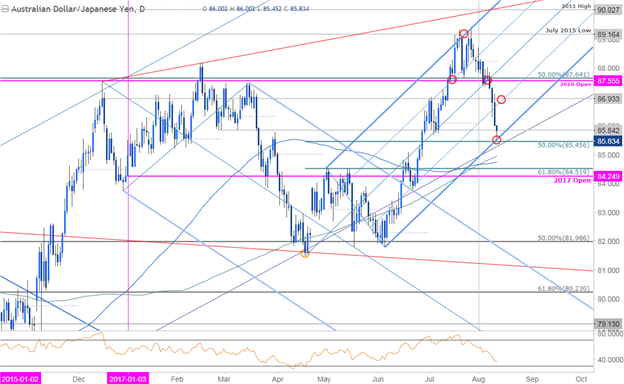

Technical Outlook: AUDJPY has been trading within the confines of a well-defined ascending pitchfork formation with prices testing key confluence support today at 85.45. This level is defined by the 50% retracement of the 2017 range and the lower median-line parallel of the ascending structure. The immediate short-bias is at risk heading into this level. Resistance stands at 86.93 with our bearish invalidation level steady at 87.55/64.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

AUD/JPY 240min Chart

Notes: A near-term embedded descending pitchfork off the highs has continued to offer guidance with the upper median-line parallel highlighting a near-term resistance confluence into 86.93. A break above this level would put us neutral with a rally surpassing 87.64 needed to mark resumption of the broader up-trend.

A break below this key support zone targets the lower parallel, which converges on the 61.8% retracement at 84.52. From a trading standpoint, I’d be looking for a rebound here but the larger focus remains lower while within this near-term formation.

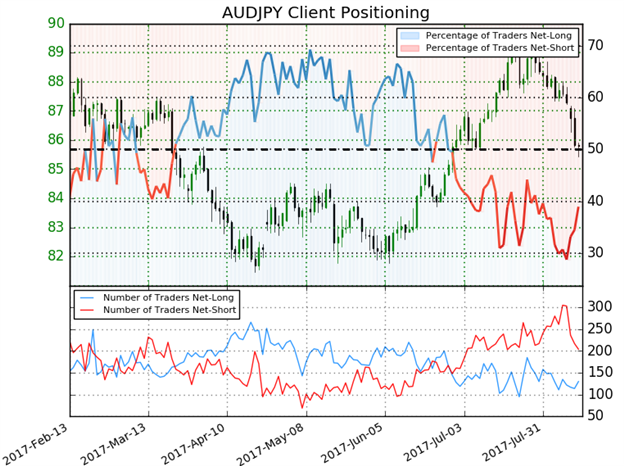

- A summary of IG Client Sentiment shows traders are net-short AUD/JPY- the ratio stands at -1.57 (38.9% of traders are long) –bullishreading

- Retail has been net-short since June 29th- price has rallied 1.9% since then

- The percent of traders net-long is now its highest since August 2nd – price was trading at 88.16

- Long positions are 3.2% higher than yesterday but 2.3% lower from last week

- Short positions are 14.6% lower than yesterday and 22.5% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUDJPY prices may continue to rise. That said, the recent changes in sentiment warn that the current AUDJPY price trend may soon reverse lower despite the fact traders remain net-short.

What to look for in AUD/JPY retail positioning - Click here to learn more about sentiment!

---

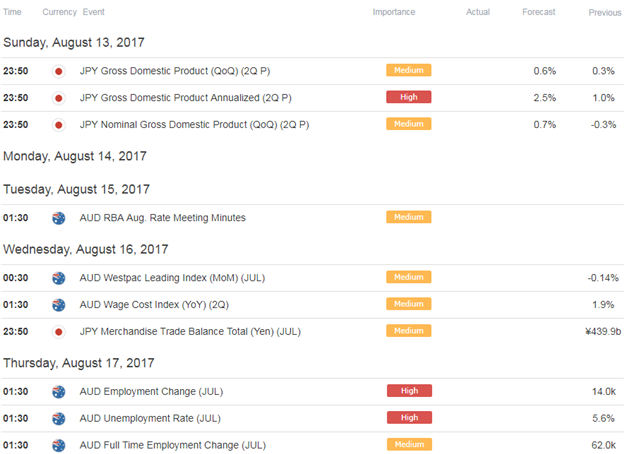

Relevant Data Releases

Other Setups in Play:

- Ethereum at Risk Near-term as Prices Rally to Fresh Monthly Highs

- NZD/JPY Breakdown in Focus Ahead of RBNZ, Bearish Sub-81.67

- EUR/JPY: Break of Monthly Opening Range to Offer Guidance

- Strategy Webinar: Dollar Rebound in Focus as Euro, Pound Risk Exhaustion

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.