To receive Michael’s analysis directly via email, please SIGN UP HERE

- Ethereum breakout approaching secondary resistance targets

- Check out our New 3Q projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

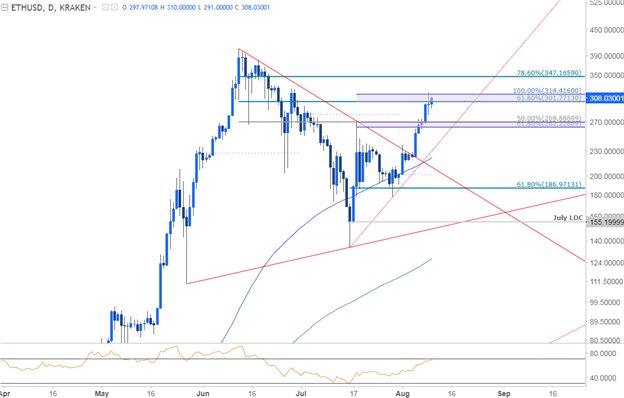

ETH/USD Daily Chart (Log-Scale)

Technical Outlook: Ethereum prices broke above basic trendline resistance extending off the yearly highs with the rally now approaching more significant resistance at the confluence of the 100% ext and the 61.8% retracement at 302/14. While our broader outlook remains weighted to the topside, the immediate advance is at risk while below this threshold. Interim support rests at 262/70 with broader bullish invalidation set along the trendline extending off the July lows, currently ~237.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

ETH/USD 240min Chart

Notes: A closer look at price action highlights this week’s reversal off confluence resistance at the 100% ext at 314. Ethereum has continued to trade within the confines of an ascending pitchfork formation extending off the July lows with our focus weighted to the topside while in this formation.

Look for interim support along the median-line with the focus higher while above 269/73. A breach of the highs targets the upper median-line parallel which converges on the 78.6% retracement at 347.From a trading standpoint, I’d be looking for a pullback here to ultimately offer more favorable long entries.

---

Relevant Data Releases

Other Setups in Play:

- NZD/JPY Breakdown in Focus Ahead of RBNZ, Bearish Sub-81.67

- EUR/JPY: Break of Monthly Opening Range to Offer Guidance

- Strategy Webinar: Dollar Rebound in Focus as Euro, Pound Risk Exhaustion

- USD/CAD Price Action Primed for NFP, Canada Employment

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.