To receive Michael’s analysis directly via email, please SIGN UP HERE

- AUD/USD responds to slope support ahead of key event risk

- Check out our New AUD/USD 3Q projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

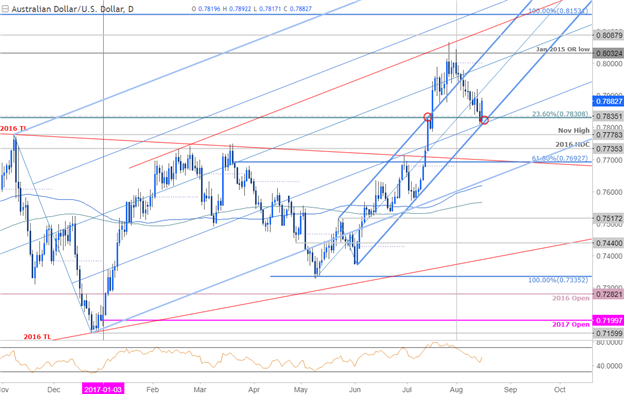

AUD/USD Daily Chart

Technical Outlook: AUDUSD rebounded off confluence support today at the lower parallel of this formation extending off the May & June lows. Note that this level also converges on the 50-line of the broader 2016 pitchfork formation.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

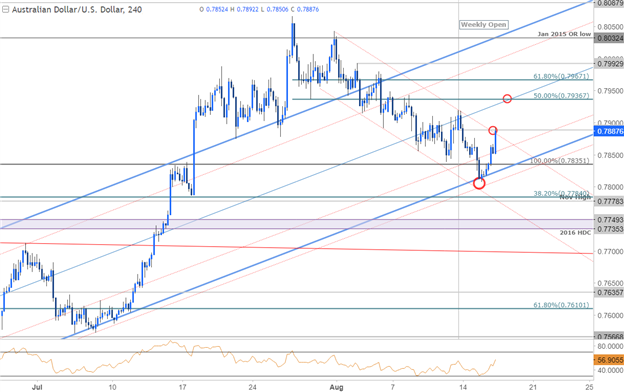

AUD/USD 240min Chart

Notes: A closer look at price action highlights a near-term bullish flag pattern off the highs with prices now testing channel resistance / the weekly open at 7889. Look for interim support at 7835 with our focus higher in the pair while within this ascending formation. A breach higher from here targets the 50% retracement of the August decline at 7937 backed closely by the 61.8% retracement at 7967.

A close below this formation would invalidate the long-bias with such a scenario targeting 7778 and the 2016 high-day close at 7735. Added caution is warranted heading into the release of the FOMC minutes today and Australia employment figures later tonight with the events likely to fuel increased volatility in their respective crosses. Keep in mind that markets are already expecting a strong read on employment, leaving the immediate risk to the downside on a weaker print. That said, from a trading standpoint I’ll favor fading weakness while above the lower parallel targeting a break of the weekly highs.

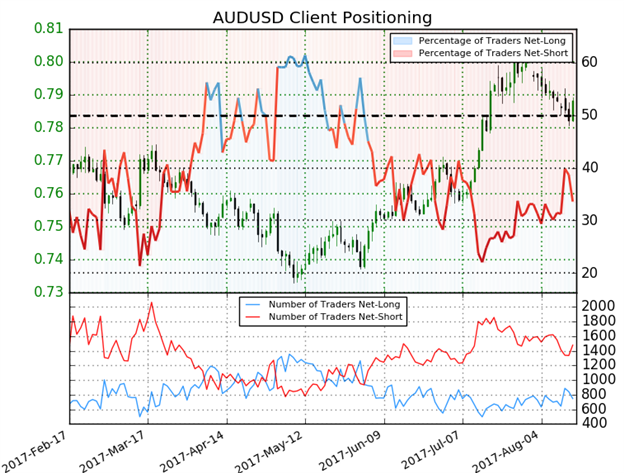

- A summary of IG Client Sentiment shows traders are net-short AUD/USD- the ratio stands at -1.98 (33.6% of traders are long) –bullishreading

- Retail has been net-short since June 4th- Price has moved 5.7% higher since then

- Long positions are 1.8% lower than yesterday but 6.1% higher from last week

- Short positions are 4.0% higher than yesterday and 9.9% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise. That said, traders are more net-short than yesterday but less net-short from last week and the combination of current positioning and recent changes gives us a further mixed AUDUSD trading bias form a sentiment standpoint.

See how shifts in AUDUSD retail positioning are impacting trend- Click here to learn more about sentiment!

---

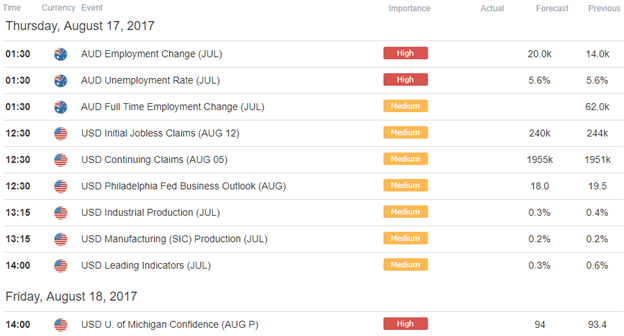

Relevant Data Releases

Other Setups in Play:

- GBP/USD Prices Testing Support- Risk for Further Losses Remains

- Strategy Webinar: Dollar Recovery Looks to FOMC Minutes for Fuel

- AUD/JPY Testing Key Support as Risk Aversion Drives Yen

- Ethereum at Risk Near-term as Prices Rally to Fresh Monthly Highs

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.