To receive Michael’s analysis directly via email, please SIGN UP HERE

Talking Points

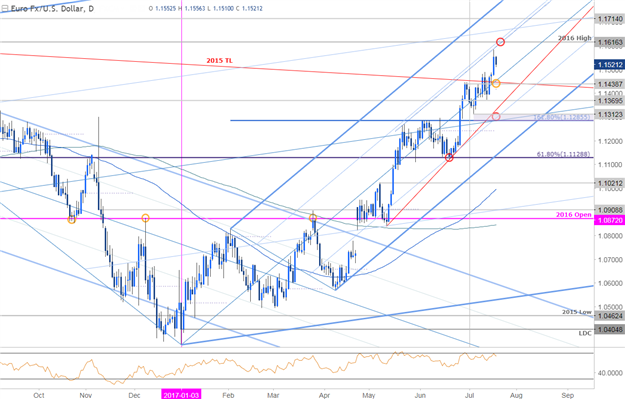

- EUR/USDresponds to up-slope resistance, looking for validation of 2015 trendline breakout

- Check out our New 3Q projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

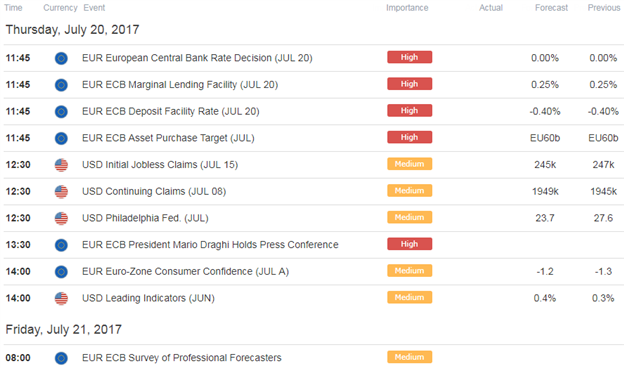

Technical Outlook: Euro tested up-slope resistance yesterday after breaking above a multi-year trendline extending off the August 2015 high. Heading into the European Central Bank (ECB) interest rate decision tomorrow, the immediate focus range is 1.1439-1.1616. The immediate advance as at risk while within this range with the broader outlook weighted to the topside while above 1.1285.

Learn more about Pitchfork formations in Michael’s three-part trading series

EUR/USD 240min Timeframe

Notes: A closer look at price action sees the pair reversing off up-slope resistance this week with the 2016 high converging on the 75% line just higher at 1.1616. Interim support rests at 1.1495 with the immediate focus higher while above 1.1439- A break below this region would risk a larger correction targeting 1.1366 & broader bullish invalidation at 1.1285-1.1312.

A breach of the highs keeps the broader long-bias in play targeting subsequent topside objectives at 1.1714 & the upper parallel (currently ~1.1770s). As always, these interest rate decisions invite a great deal of volatility and the focus will be on the accompanying commentary from President Mario Draghi.

From a trading standpoint, I would be looking to fade weakness on a spike lower tomorrow into the lower parallels – If euro is heading higher, price should hold above the weekly range lows. At the same time, failure at the upper parallel again would suggest near-term exhaustion in price- stay nimble into the release.

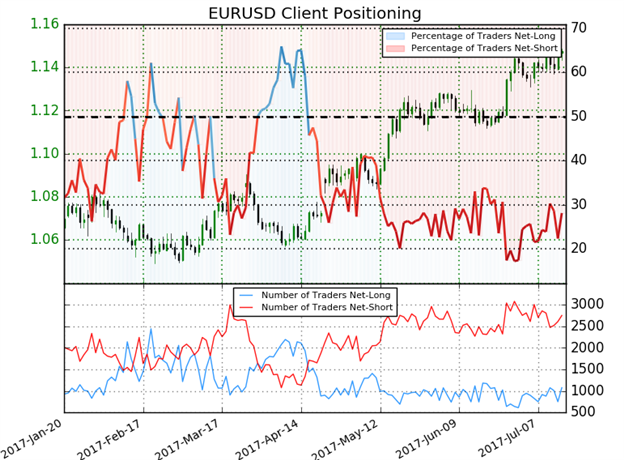

- A summary of IG Client Sentiment shows traders are net-short EUR/USD- the ratio stands at -2.27–bullish reading

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. That said, Positioning is less net-short than yesterday but more net-short from last week and the combination of current sentiment and recent changes gives us a further mixed near-term trading bias.

- Bottom line: Sentiment is coming off extremes and highlights the near-term risk to this advance in the Euro but ultimately, I’m looking to fade a pullback in the pair targeting a breach of the 2016 highs.

What to look for in EUR/USD retail positioning - Click here to learn more about sentiment!

---

Relevant Data Releases

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

Other Setups in Play:

- GBP/USD Rejected at Resistance- Price Constructive Above 1.2890

- AUD/JPY Rallies to Fresh Yearly Highs – Initial 2017 Targets in View

- Strategy Webinar: Aussie Breakout Testing 2016 Highs- What Next?

- USD/JPY Rally Vulnerable Ahead of U.S. CPI

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.