Talking Points

- USDJPY vulnerable to US event risk- constructive above 112.39

- Updated targets & invalidation levels

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

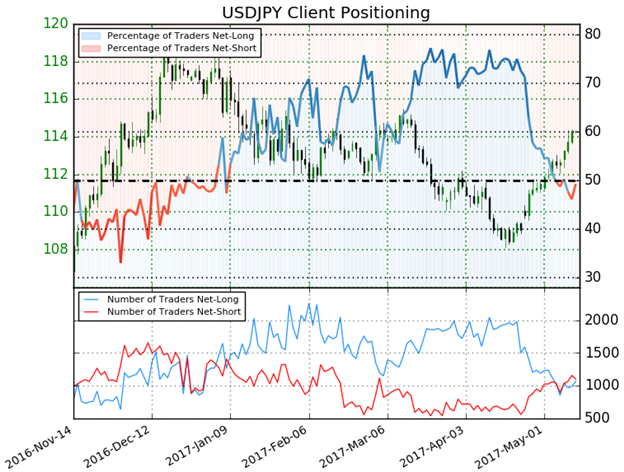

USDJPY Daily

Technical Outlook: USDJPY broke above channel resistance extending off the 2017 highs and the 100-day moving average this week with the rally turning just ahead of the 61.8% retracement of the decline at 114.61. The broader focus remains constructive while above former channel resistance with a breach higher targeting a key resistance zone at 115.51-116.08.

Check out our USD/JPY 2Q projections in our Free DailyFX Trading Forecasts

Notes: A closer look at price action highlights a medium-term slope we’ve been tracking off the April lows with the divergence into the upper parallel fueling some losses into the US trade session. The pullback is now testing an embedded pitchfork and a break of this support may be the first signal of a more meaningful pullback in USDJPY. That said, interim support rests at 112.90 backed by 112.39 (near-term bullish invalidation).

While the immediate topside bias remains at risk, ultimately I’d be looking to fade a pullback with a breach higher targeting 114.61- a rally surpassing this region eyes subsequent topside objectives at 115.52 & 116.08/14.

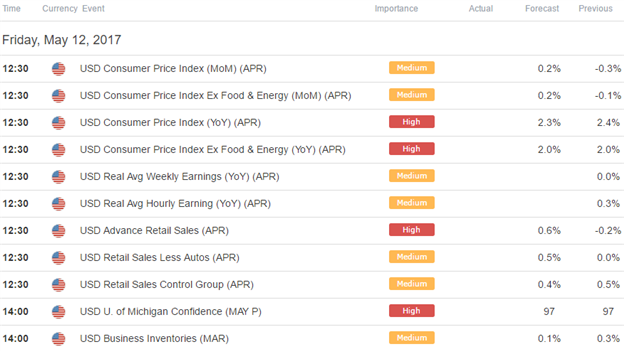

A third of the daily average true range (ATR) yields profit targets of 27-31 pips per scalp. Added caution is warranted heading into a flurry of U.S. economic data tomorrow with the release of the April Consumer Price Index (CPI), Retail Sales figures & the University of Michigan sentiment surveys likely to fuel increased volatile in the dollar crosses. As it pertains to the Fed policy, keep a close eye on the wage growth figures to potentially be the broader driver of price action following the release.

- A summary of IG Client Sentiment shows traders are net-short USDJPY- the ratio stands at -1.03 (49.2% of traders are long)- weak bullish reading

- Retail traders have been net-short since April 18- the pair is up 3.1% since then

- Long positions are 3.9% lower than yesterday and 7.0% below levels seen last week

- Short positions are 0.5% higher than yesterday but 4.7% lower from last week

- While broader sentiment continues to point higher, the recent narrowing in the ratio does leave the immediate topside bias vulnerable heading into tomorrow’s U.S. event risk. That said, from a trading standpoint, I’ll favor fading weakness into structural support.

See how shifts in USD/JPY retail positioning are effecting market trends.

---

Relevant Data Releases

Other Setups in Play:

- USDMXN Responds to Wall of Resistance

- GBP/USD: Rally Under Review- Bank of England Super Thursday on Deck

- NZD/USD: Vulnerable Ahead of RBNZ – Range Break in Focus

- Post-French Election EUR/USD Game Plan

- Webinar: Post NFP / French Elections Setups- RBNZ, BoE in Focus

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.