Talking Points

- EURUSD testing initial support- Broader focus higher above 1.0872

- Updated targets & invalidation levels

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook:The Sunday post-election gap briefly saw EURUSD above resistance at 1.0984 before pulling back in Asia trade. Interim support rests at the November high-day close at 1.0909 backed by the 2016 open at 1.0872 (near-term bullish invalidation). Note that this level is also converges on the median-line of the modified ascending pitchfork formation we’ve been tracking off the yearly low. A breach higher eyes subsequent topside targets at the December 2015 high at 1.1060 and the upper parallel / 78.6% retracement at 1.1095.

Check out our EURUSD 2Q projections in our Free DailyFX Trading Forecasts.

EUR/USD 240min

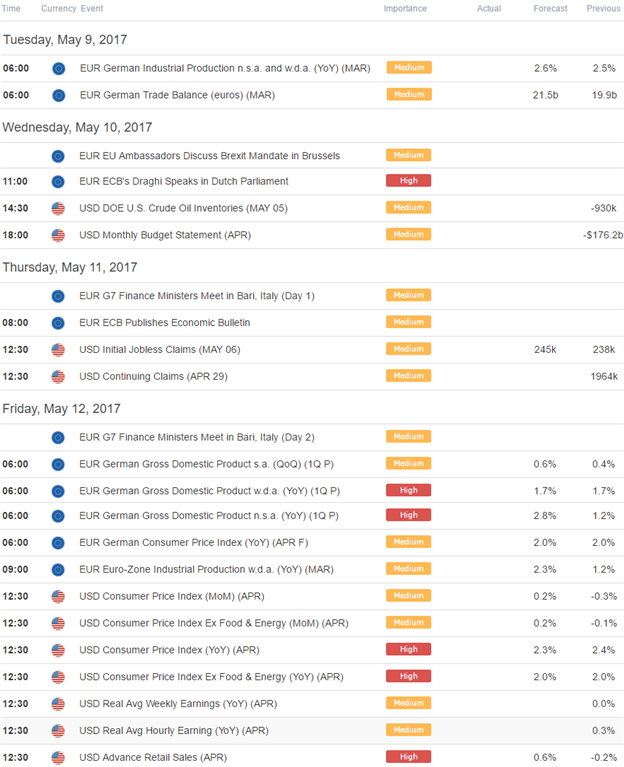

Notes: A closer look at price action highlights an embedded pitchfork formation extending off the April lows with the recent pullback now testing neat-term support at 1.0919/30. Note that the pair has mark ben marking bearish divergence on multiple time-frames while the immediate risk remains for a move lower, the broader focus remains constructive while above the median-line / 1.0872 to open the week. A third of the daily average true range (ATR) yields profit targets of 24-28pips per scalp. Added caution is warranted heading into Eurozone GDP & US CPI data later in the week with the data likely to fuel increased volatility in the respective crosses.

- A summary of IG Client Sentiment shows traders are net-short EURUSD- the ratio stands at -1.47 (40.5% of traders are long)- bullish reading

- Retail traders have been net-short since April 18- the pair is up 3.1% since then

- Long positions are 54.5% higher than yesterday and 22.0% higher from last week

- Short positions are 9.0% higher than yesterday but 11.3% lower from last week

- While broader sentiment continues to point lower, the recent build in long-exposure suggests the immediate long-bias remains at risk into the start of the week. That said, from a trading standpoint, I’ll favor fading weakness into structural support.

See how shifts in Euro retail positioning are effecting market trend- Click here to learn more about IG Client Sentiment indicators!

---

Relevant Data Releases

Other Setups in Play:

- Webinar: Post NFP / French Elections Setups- RBNZ, BoE in Focus

- AUDUSD Breakdown Testing Support Ahead of U.S. NFP

- DXY Levels to Know as FOMC Takes Center Stage

- AUD/JPY Targets 2017 Open Ahead of RBA Rate Decision

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.