- EURCAD rebound off daily support approaches initial resistance

- Updatedtargets & invalidation levels

- Looking for trade ideas? Check out DailyFX’s 2016 4Q Projections

Chart Created Using TradingView

Broader Technical Outlook: EUR/CAD reacted to key support last week at the confluence of the September low & basic trendline support extending off the December low at 1.4380. The exchange rate has continued to respect this slope on a close basis with the subsequent rebound now targeting near-term resistance targets. We covered this setup at length in today's webinar.

EUR/CAD 240min

Notes: The pair has continued to trade within the confines of a well-defined descending pitchfork formation with the lower parallel catching last week’s BoC sell-off. We’ve been tracking the subsequent rebound on SB Trade Desk for the last few days with the rally now approaching our final target at confluence resistance around 1.4595. This level is defined by the 50% retracement of the September decline and converges on the upper median-line parallel over the next 48-hours.

A breach above this region suggests a larger recovery may be underway with such a scenario eyeing subsequent resistance objectives at 1.4673, the monthly open at 1.4743, 1.4780 and the May high at 1.4825. That said, the immediate topside bias is at risk heading into structural resistance with interim support now eyed at the weekly open at 1.4501 backed by 1.4430 & 1.4380 (bullish invalidation). From a trading standpoint I’d be looking for a reaction at the upper parallel with our broader focus higher while above daily trendline support.

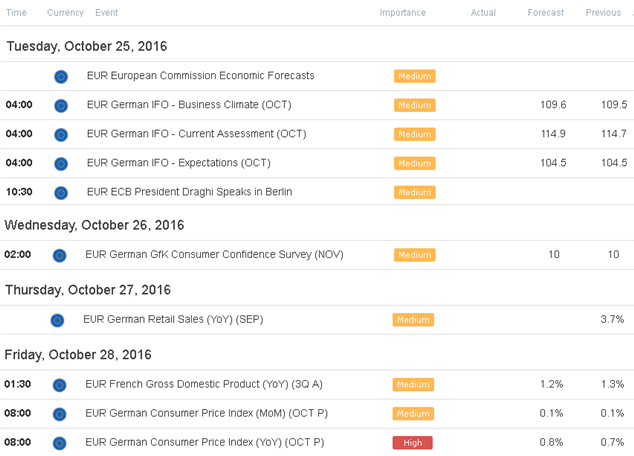

A quarter of the daily average true range yields profit targets of 30-35pips per scalp. ECB President Mario Draghi is set to speak in Berlin tomorrow morning with Eurozone CPI on Friday highlighting this week’s economic docket. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Relevant Data Releases

Other Setups in Play:

- Webinar: USD, EUR Back at Yearly Open- US GDP in Focus

- NZD/JPY Signals Near-term Exhaustion Ahead of Key Resistance

- EUR/JPY Targeting Key Support Ahead of ECB

- USD/CAD at Risk for Further Losses on Wait-and-See BoC

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)