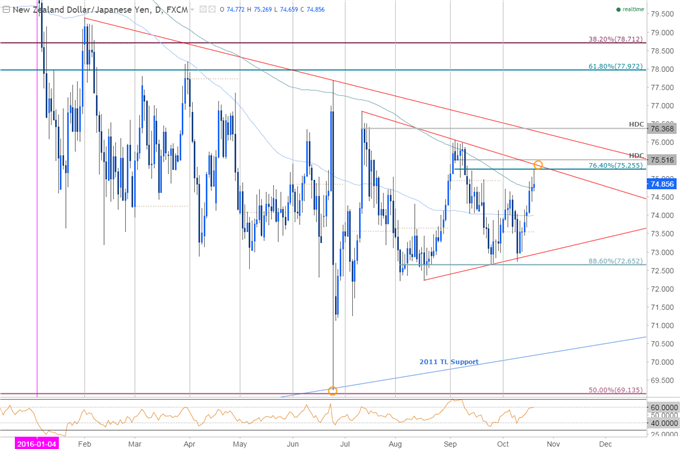

- NZD/JPY testing upper bounds of consolidation pattern

- Updatedtargets & invalidation levels

- Looking for trade ideas? Check out DailyFX’s 2016 4Q Projections

Chart Created Using TradingView

Broader Technical Outlook: NZD/JPY has been in consolidation since the Brexit sell-off with the pair now approaching confluence resistance at the upper bounds of the pattern. The resistance range extends into the September high-day close at 75.52 and the immediate long-bias is at risk while below this threshold.

NZD/JPY 240min

Notes: An ascending pitchfork extending off the September / October lows has continued to define price action with the 75% line further highlighting near-term Fibonacci resistance at 75.07/25. Note that the pair has been marking bearish divergence into these highs and leaves the advance vulnerable with a break below the median-line shifting the focus towards 74.27 & 73.68.

From a trading standpoint, I would be looking for an exhaustion high (fade strength) while below structural resistance. A break below the embedded pitchfork is needed to shift the broader focus back towards basic trendline support extending off the August lows currently ~73.00. A close above 75.52 would constitute a breakout with such a scenario eyeing targets at 76.06, 76.37 & the 100% extension at 76.52.

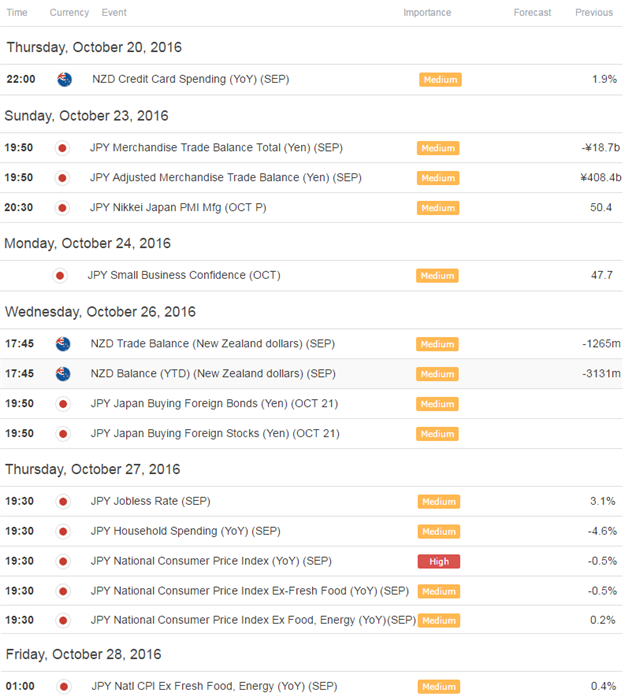

A quarter of the daily average true range (ATR) yields profit targets of 25-28 pips per scalp. The economic docket is rather quiet until next week with trade balance figures from both counterparts & Japanese CPI on tap. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Relevant Data Releases

Other Setups in Play:

- EUR/JPY Targeting Key Support Ahead of ECB

- USD/CAD at Risk for Further Losses on Wait-and-See BoC

- AUD/NZD Approaches Key Slope of Influence- Longs at Risk Sub-1.0786

- Webinar: Is the Dollar Rip Ready to Slip?

- DAX Battle Lines Drawn as Index Looks to Regain 2016 Losses

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)