Talking Points

- USDJPY breakout coming into first zone of resistance / 2007 highs

- Updated targets & invalidation levels heading into June trade

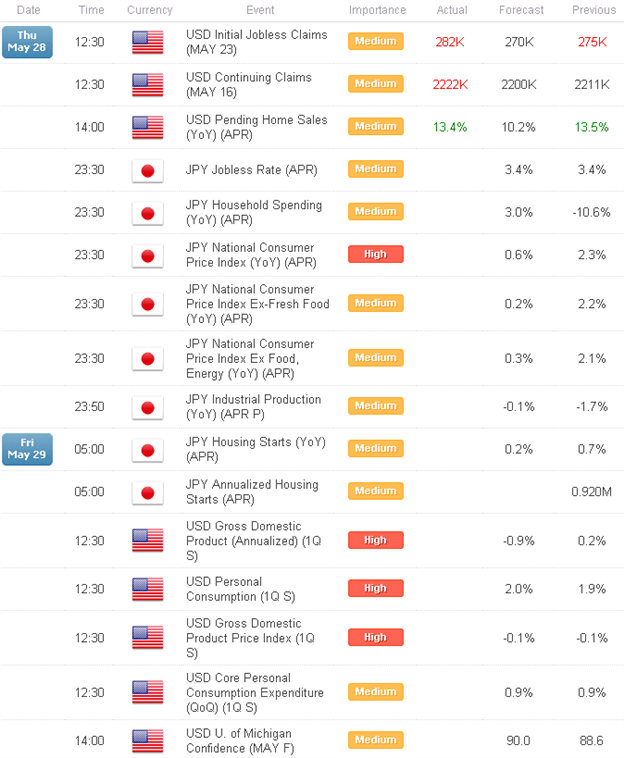

- Event Risk on TapThis Week

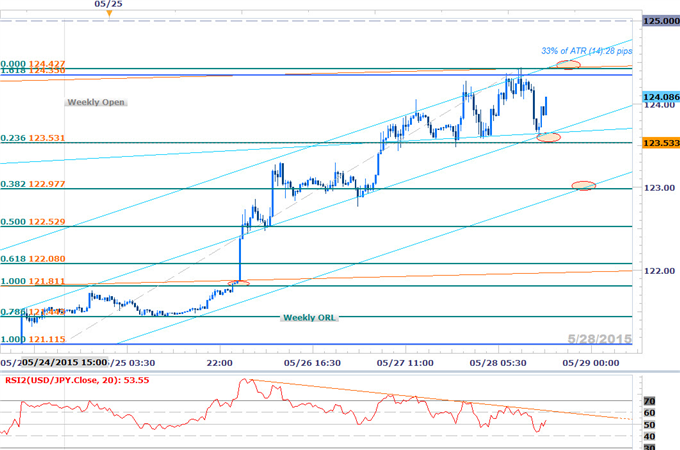

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- USDJPY testing key near-term resistance confluence 1.2413/35

- Breach targets objectives at 125.62/70 backed by ML resistance (~126.40) & 128.12/18

- Interim support with the May TL backed by 121.83-122- bullish invalidation

- Daily RSI in overbought- Constructive while this condition holds

- Event Risk Ahead: Japan Jobless Rate, CPI & Industrial Production tonight & U.S. 1Q GDP on Friday

USD/JPY 30min

Notes:USDJPY has been trading within the confines of a well-defined median-line formation with today’s rally stretching into the first level of significant resistance at 124.13/35. This zone is defined by the 2007 high, the 1.618% extension of the advance off the December low, near-term MLP resistance & a slope line extending off the January 2015 high (daily chart).

Intra-week divergence into the highs leaves the pair vulnerable for a pullback below this threshold with a break below the highlighted region into 123.53 shifting the near-term focus towards the lower MLP / 122.97. The broader bias remains constructive while above the 122-handle.

Bottom line: We’ll be looking for either a break above 124.35 or a break below this formation for guidance heading into June trade with the broader bias weighted to the topside above 122. A topside break keeps the long bias in play targeting 125 backed by 125.67/70. The average true range is rather tight here so to accommodate the near-term breakout we’ll look for a larger portion of the range with a third of the daily ATR yielding profit targets of 26-29 pips per scalp. Caution is warranted heading into U.S. event risk tomorrow morning with end of week/month flows also likely to fuel added volatility in USD crosses.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases

Other Setups in Play:

- AUDUSD Testing Key Support- Short Scalps Vulnerable Above 7680

- USDCAD Scalps Faces 1.25 Key Resistance Ahead of BoC, GDP

- GBPUSD Longs Favored Above 1.5540- Scalps Target May Highs

- EURCAD Pullback Stalls at Support- Sub 1.3538 to Negate Bullish Bias

- Scalp Webinar: USD At Risk For Bearish Invalidation- 11,737 In Focus

- NZDJPY Rebound Testing Resistance- Scalps Target 89.50 Inflection Zone

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex,contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video