Talking Points

- GBPAUD weekly opening range taking shape below key resistance

- Longs at risk- Range break to validate near-term scalp bias

- Event Risk on Tap

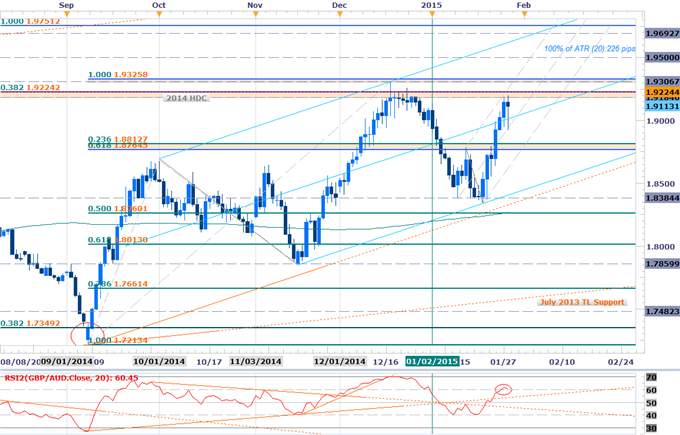

GBP/AUD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- GBPAUD testing key resistance range / 2014 highs- bearish invalidation

- Outside day reversal candle today- bearish

- Interim support at January pitchfork bisector (grey dashed) & 1.8765-1.8812

- Daily RSI turning over at 60- bearish near-term

- Event Risk Ahead: RBA Interest Rate Decision on Monday & BoE Interest Rate Decision next Thursday

GBP/AUD 30min

Notes:The GBPAUD has made a well-defined weekly opening range (1.8920 – 1.9195 ) just below key resistance and we’ll look for a break of this range to validate our near-term scalp bias. Note that the pair has been trading within the confines of an ascending pitchfork formation off the monthly lows with today’s low tagging the median line bisector. The trade remains constructive while above this threshold which currently lines up with the weekly opening range low around 1.8920/36.

Bottom line: Our long scalp-bias is at risk sub-1.92 with a break below the weekly opening range targeting shorts into subsequent support targets at 1.8872, 1.8767 & the lower median-line parallel (currently around 1.8670. A breach above the weekly range highs targets channel resistance and the 1.9305/27 key resistance range. Note that this region is defined by the 2014 high and the 100% extension of the advance off the 2014 low and if breached is likely to fuel extended topside advances for the pair. Event risk for the GBPAUD is likely to be limited into the end of this week with the RBA & the BoE on tap next week. Caution is warranted during these releases as they are likely to fuel added volatility in AUD & GBP crosses.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

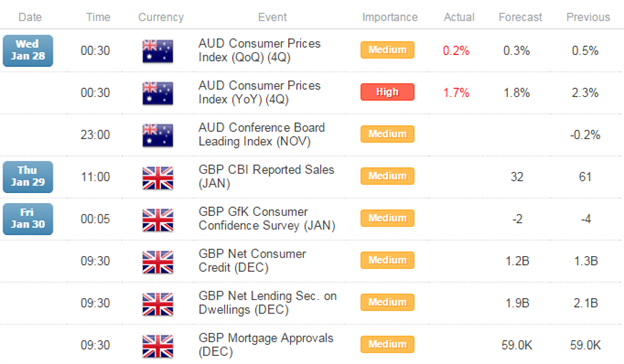

Relevant Data Releases

Other Setups in Play:

- Scalping the AUDCAD Reversal- Shorts Favored Below 9928

- Gold Stalls at Technical Resistance- Remains Constructive Above 1262

- Scalping NZD/JPY Breakdown- Shorts Favored Sub 90.00

- AUDUSD Scalps Target 8300 Resistance

- GBPUSD Reversal Pauses at Resistance- Longs Favored Above 1.5170

- USDJPY Threatens Opening Range- Sub 118 Targets In View

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video