COPPER PRICE OUTLOOK – Talking Points:

- Copper prices coiling up for a breakout between key chart barriers

- US-China trade talks at an impasse over tariffs, Hong Kong turmoil

- Incoming news-flow might flag ongoing global growth slowdown

Where will markets end 2019? See our Q4 forecasts for currencies, commodities and stock indexes !

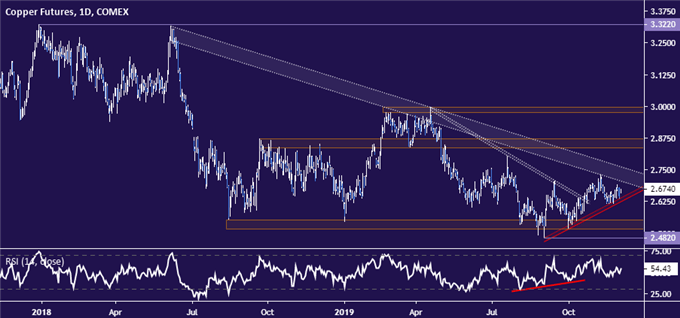

Copper prices are coiling up between critical chart barriers, setting the stage for what could be a trend-defining move ahead. Resistance is marked by a downward-sloping barrier capping upside progress since mid-2018. A rising trend line established from early-September lows stands as near-term support.

Breaking higher – with confirmation on a daily close above 2.7610 – opens the door to challenge the 2.8355-8710 chart inflection zone. Alternatively, a breach of support – now at 2.6240 – looks likely to pave the way for a test of the 2.5160-5520 price floor dating back to mid-August of 2018.

Copper price chart created with TradingView

Copper’s recent recovery has tracked an upshift in priced-in 2020 Fed policy outlook. This suggests that hopes for a breakthrough in US-China trade talks and ebbing worries about a “no-deal” Brexit appear to have been the key catalysts at work. Similar moves have appeared in Asia-Pacific and European stocks.

COPPER AT RISK ON US-CHINA TRADE DEAL IMPASSE, GROWTH SLOWDOWN FEARS

That sets the stage for volatility as Beijing and Washington DC struggle to make progress. News-flow over the weekend pointed to a deepening impasse over rolling back tariffs, which China wants in any “phase 1” deal but the US opposes, and the latter’s support for Hong Kong’s pro-democracy protesters.

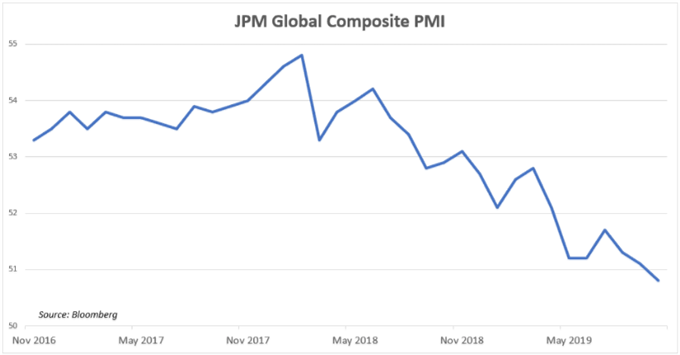

Against this backdrop, a steady stream of economic data releases – particularly out of the US – may remind investors that the global economy continues to slow. Indeed, the JPMorgan Composite PMI gauge of worldwide manufacturing- and service-sector growth is hitting multi-year lows.

Ominous rhetoric in testimony from ECB President Christine Lagarde at the EU Parliament and policy announcements from the RBA and the BOC may sour the mood further All this bodes ill for cycle-sensitive copper prices, hinting that the looming chart break might favor the downside.

COPPER TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter