Crude OilTalking Points:

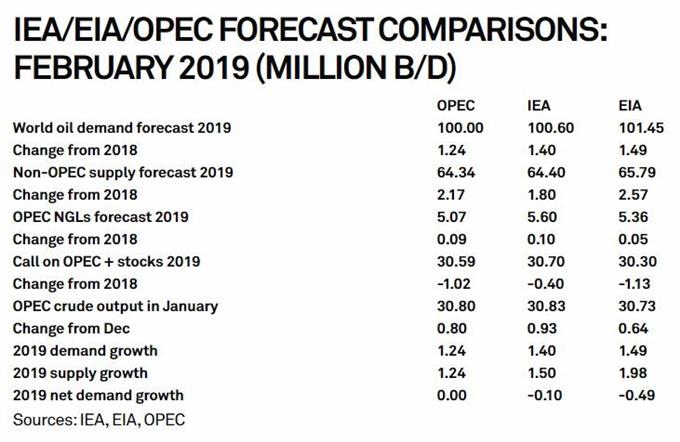

- Three top oil forecasting agencies have highlighted non-OPEC supply as a downward pressure

- Despite an OPEC cut, supply should remain considerable despite US sanctions on Iran and Venezuela

- Supply glut comes as crude demand questioned

Crude Oil Price Outlook - Fundamental

Forecast: Bearish

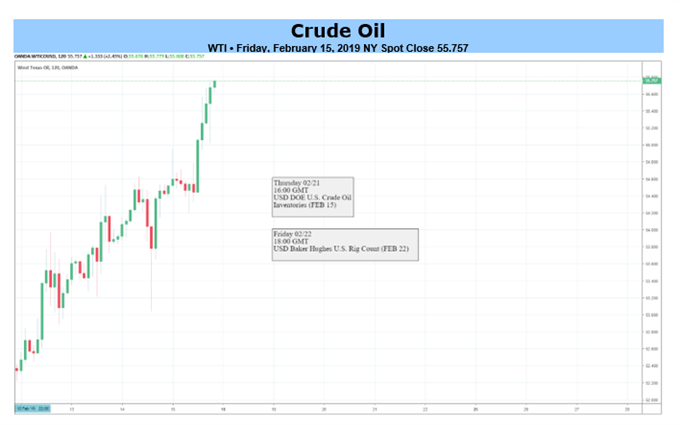

West Texas Intermediate (WTI) crude oil posted solid gains last week, climbing from roughly $52.60 to close Friday around $55.20. While the week helped the broader effort to rebound from the precipitous decline that started in October, crude has slowed its ascent considerably from earlier in the year. With that said, last week’s gains were posted amid a bearish report from the IEA that warned of considerable production capacity from non-OPEC members.

Source: S&P Global

Looking for a technical perspective on Crude Oil? Check out the Weekly Crude Oil Technical Forecast.

The report echoed warnings from the EIA and OPEC, also closely watched crude forecasting agencies. With all three sounding off on a seemingly bearish development, the outlook for the week ahead will reflect as such.

Want to try your hand at trading Crude Oil? Check out our Understanding the Core Fundamentals of Oil Trading Guide.

Crude’s price may see compounded pressure as the outlook for fuel demand is called into question amid global growth concerns. Both the IEA and EIA have forecasted a decrease in crude demand for 2019 while OPEC envisions no change from 2018. Barring further OPEC cuts or a surprise fundamental development, crude looks to remain pressured.

Read more: Consumer Confidence Ticks Higher, Inflation Expectations Plummet

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact Peter on Twitter at @PeterHanksFX

DailyFX forecasts on a variety of currencies such as the US Dollar or the Yen are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introduction to the Forex market, check out our New to FX Guide.

Other Weekly Fundamental Forecast:

Australian Dollar Forecast –May Head Lower If RBA Jawboning Starts Anew