EURO TALKING POINTS - EUR/USD, ECONOMIC AND FINANCIAL AFFAIRS COUNCIL

- EUR/USD in focus as Euro-area Finance Ministers meet

- Potentially market-moving topics: budgets and trade

- Euro may move on key announcements or developments

See our free guide to learn how to use economic news in your trading strategy!

EU TRADE POLICIES – IRAN, US, INSTEX

Finance Ministers and other key officials from each of the 27 EU member states are in Brussels for the Economic and Financial Affairs Council meeting to discuss policies from trade to budgets. One of the more heavily covered points of discussion has been the bloc’s trading relationship with Iran against the backdrop of US sanctions.

After Washington shredded the 2015 nuclear deal and reimposed sanctions against Tehran, the EU looked for ways to preserve the deal without incurring the penalties from the US. European policymakers have designed and launched a Special Purpose Vehicle (SPV) known as INSTEX, an acronym for Instrument in Support of Trade Exchanges.

The framework allows for EU businesses to circumvent US sanctions and facilitate trade with Iran without incurring any penalties. Previously the White House threatened that any companies that continue to trade with Iran may lose access to US financial markets. European businesses are hesitant to test out the new policy considering the possible profit from accessing the Iranian market would be offset by the potential loss of losing access to the US.

The EU’s incentive to continue trading with Iran has to do with former’s political stake in preserving the nuclear deal. By trading with Iran, European policymakers hope the economic support will push officials in Tehran to honor the agreement and avoid a nuclear arms race in the region.

The US so far has not reacted or acted against the EU. When asked to comment on INSTEX, the US State Department stated they are closely monitoring the program but reiterated the president’s initial position: any companies trading with Iran risk losing access to the US’s financial markets.

If the US were to impose penalties against Europe and potentially threaten another tit-for-tat trade spat, appetite for risk would likely turn sour and further dampen the outlook for growth in 2019.

The assets that will likely react negatively to any deterioration between EU-US relations will likely be the risk-sensitive Australian and New Zealand Dollar as well as the Euro. In this environment, anti-risk currencies such as the US Dollar and Japanese Yen will likely outperform against their risk-loving counterparts.

EU BUDGET – EUROZONE RISKS, ITALY BUDGET IN FOCUS

Another potential market-moving topic will be on how to set up the budget for all of the Eurozone member states (MS). Discussions on this topic will likely generate a lot of friction due to the uneven economic terrain of each member state. France has been the biggest advocate of pushing for a larger budget and a separate pool of capital to be had in store and used to counter economic shocks.

On the other hand, Germany – with its classically prudential approach to pecuniary matters intact – suggested a smaller budget. However, all budget laws must be broadly in-line with overarching regulatory parameters and meet several budgetary criteria before anything can even be formally proposed.

Ultimately, the EU Commission will have to prepare the final version before it is officially signed into law. The current proposed budget is for 55 billion Euros, 30 of which would be used to support investments in MS’s that are facing economic hardships. As recent data has shown, such stimulus might be needed as the three largest Eurozone economies – Germany, France and Italy – all struggle with growth.

The latter with a technical recession.

The EU Economic Commissioner Pierre Moscovici told Italian officials that there will not be a revival of the disciplinary procedure over the country’s controversial budget. Such an action would exert more market pressure than perhaps the country could currently withstand. However, Italy’s budget will be discussed as part of the Commission’s routine supervision of fiscal policies by member states.

These talks have already drawn criticism by Australian Finance Minister Hartwif Loeger who stated that Italy’s budget must be discussed. He expressed disdain toward Brussels for capitulating to the Italian government’s budgetary demands. “I do not understand why the commission gave in so quickly” he said. Such sentiment – while perhaps not made as obvious – is probably shared among other member states.

IMPACT ON EURO

While any direct impact on the Euro's price movement may not be noticeable, the effect could be of a subtler nature. Against the backdrop of slower growth and political fragmentation, negative news from the talks may further weigh on bullish sentiment.

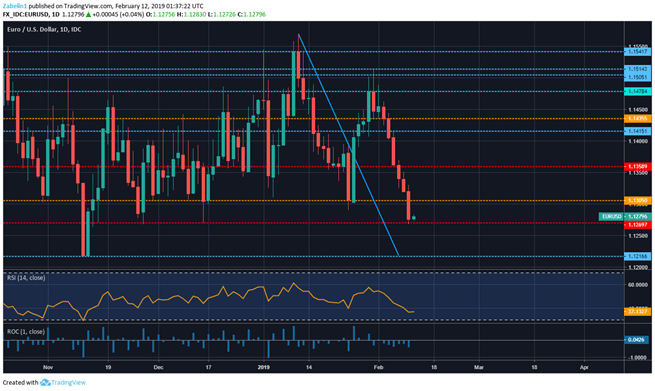

Since January 31 EUR/USD has shaved off almost two percent after breaking through several key support levels. Right now the pair is struggling to keep above 1.1269 after closing lower for six consecutive days. Short-term price movement may be between 1.1269-1.1279. If the pair break below the lower bound, the next possible support stands at 1.1216.

EUR/USD - Daily Chart

EUR/USD TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners' guide for FX traders

- Having trouble with your strategy? Here's the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter