Talking Points:

- The US Dollar starts the week breaking its 2017 lows, on its way to its lowest level since January 2, 2015.

- There are five events worth paying attention to this week: UK CPI on Tuesday; Euro-Zone CPI and the Bank of Canada rate decision on Wednesday; and Australian jobs data and Chinese GDP on Thursday.

- Retail trader positioning is pointing to more rough trading ahead for the US Dollar we turn through the middle of the month.

Join me on Mondays at 7:30 EST/12:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

01/16 Tuesday | 09:30 GMT | GBP Consumer Price Index (DEC)

The British Pound’s post-Brexit base effect weakness has fully worked its way out of markets, but a new tailwind has emerged in recent months: the persistent climb higher by energy prices. Accordingly, with inflation having a cushion, consensus forecasts are calling to see price pressures increase by +0.4% from +0.3% (m/m) and +3.0% from +3.1% (y/y). Likewise, Core CPI is expected to dip to +2.6% from +2.7% (y/y).

Unlike inflation reports in previous months, the upcoming data release doesn’t hold much importance for the Sterling in the near-term. Even as BOE policymakers have warned that headline CPI could stay over +3% through the Q4’17, the November rate hike was a one-off event; it was not the beginning of a rate hike cycle. Inflation will need to persist above +3% through early-2018 if rates markets are going to pull forward the timing of the next hike – currently pegged at August 2018.

Pairs to Watch: EUR/GBP, GBP/JPY, GBP/USD

01/17 Wednesday | 10:00 GMT | EUR Euro-Zone Consumer Price Index (DEC F)

Much to policymakers chagrin, price pressures remain stubbornly low in the Euro-Zone, with neither the core nor the headline figure near the European Central Bank’s +2% medium-term target. The final revision to the December readings could very well be the wrinkle that gives traders pause in their determination to push the Euro higher, even if momentarily. Due in at +1.4% from +1.5% (y/y), and at +0.4% from +0.1% (m/m), the report doesn’t seem like it’s poised to be fuel for more upside. But any pause the inflation data give mid-week should be temporary.

Market measures of inflation continue to trend higher, and with the 5-year, 5-year inflation swap forwards, one of ECB President Draghi’s preferred gauges of inflation, closing last week at 1.739% - its highest level since February 21, 2017 – the ECB is probably feeling confident about its current trajectory of normalizing policy. Any setback in the Euro should be temporary.

Pairs to Watch: EUR/GBP, EUR/JPY, EUR/USD

01/17 Wednesday | 15:00 GMT | CAD Bank of Canada Rate Decision

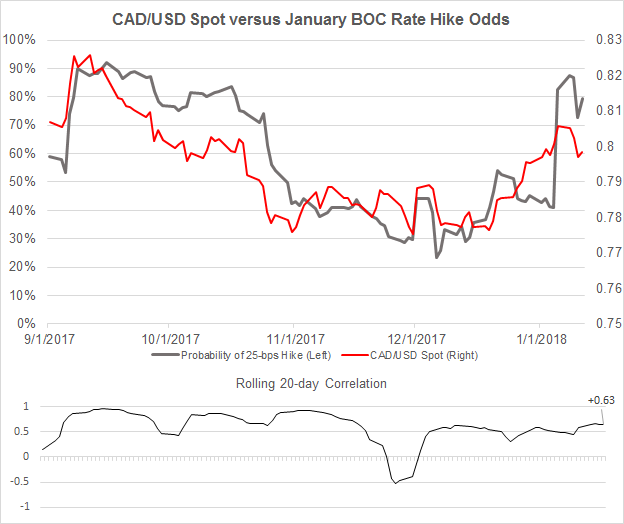

The Canadian Dollar has had a strong start to 2018, in large part thanks to a rapid repricing of BOC rate hike expectations. After the December policy meeting, overnight index swaps were pricing in a 35% chance of a January rate hike. Entering the week of the January policy meeting, corresponding rate hike odds have climbed above 85%. The reasons are two-fold: the last two inflation reports and the last two employment reports have been much better than anticipated.

As such, with rate hike odds for next week's BOC meeting still needing to converge at 100% when the rate hike is actualized, the Canadian Dollar should still be well-supported (the 20-day correlation between CAD/USD and January 2018 hike odds is +0.63).

While this means a retest of the yearly lows for USD/CAD near 1.2350 could be on the horizon, it also means that the BOC will have to offer additional hawkish forward guidance on rates (i.e. suggesting that another rate hike could happen by June to keep the BOC on track for a minimum of three this year) to provoke a move down to fresh yearly lows.

Pairs to Watch: CAD/JPY, EUR/CAD, USD/CAD

01/18 Thursday | 00:30 GMT | AUD Employment Change and Unemployment Rate (DEC)

Australian employment increased by +61.6K in November, and the report could be considered the catalyst for the Australian Dollar’s turning point last month. With the unemployment rate dropping down to 5.4%, the Reserve Bank of Australia is probably looking for nothing more than signs of stable growth rather than another blowout print to keep their optimism about the labor market intact. Current forecasts call for +15.0K jobs to have been added last month and for the unemployment rate to have held at 5.4%, in what should amount to another strong labor report overall.

But despite the steadily improving state of the labor market, uneven economic data appears to be a wrinkle in the outlook for the RBA, which continues to note that real wage growth trends aren’t strong enough to provoke a rate hike any time soon. Interest rate expectations (per overnight index swaps) show July 2018 as the most likely period for the next rate hike; this is only one month sooner than what was being priced in back in October 2017.

Pairs to Watch: AUD/JPY, AUD/NZD, AUD/USD

01/18 Thursday | 07:00 GMT | CNY Gross Domestic Product (Q4)

The Chinese economy is forecast to have grown by +6.7% on an annualized basis in the fourth quarter, essentially the same rate of growth seen during the individual quarters in 2016 and 2017. Once again, for 2018, the Chinese government is targeting the economy to grow between +6.5% and +7.0%. As the Chinese government guides growth rates lower as the economy matures, it’s important to recognize that the growth readings are the lowest in nearly three decades – since 1990.

Yet as the slight deceleration in growth is largely controlled by the Chinese government, there is little reason to think much of it at present time. At the start of the week, USD/CNH had broken down through its 2017 lows, highlighting how little concern the market has regarding the Chinese economy.

Pairs to Watch: AUD/JPY, NZD/JPY, AUD/USD, NZD/USD, USD/CNH

Read more: Euro Turns to 2017’s Final CPI Figures After ECB Minutes Hint at Faster Exit

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com.

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX.

To receive this analyst’s reports, sign up for his distribution list.

Don’t trade FX but want to learn more? Read the DailyFX Trading Guides.