The piercing line pattern consists of two candlesticks, which suggests a potential bullish reversal within the forex market. This piercing pattern should not be used in isolation but rather in conjunction with other supporting technical tools to confirm the piercing pattern.

This article will cover:

- What is a piercing pattern?

- How to identify a piercing pattern on forex charts

- Top tips for trading with the piercing line pattern

- How reliable is the piercing line?

Test your knowledge of forex patterns with our interactive 'Forex Trading Patterns' quiz

What is a piercing pattern?

The piercing line pattern is seen as a bullish reversal candlestick pattern located at the bottom of a downtrend. It frequently prompts a reversal in trend as bulls enter the market and push prices higher.

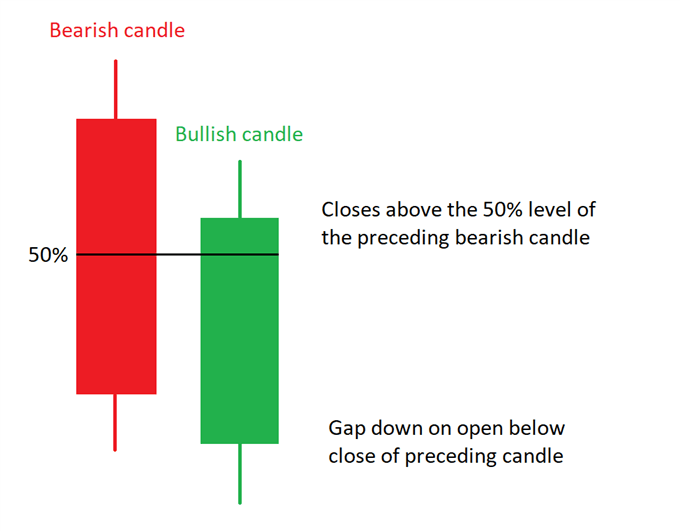

The piercing pattern involves two candlesticks with the second bullish candlestick opening lower than the preceding bearish candle. This is followed by buyers driving prices up to close above 50% of the body of the bearish candle.

The image below highlights the intricacies of the two candlesticks making up the piercing pattern:

How to identify a piercing pattern on forex charts?

Characteristics of a piercing pattern:

- Occurs at the bottom of a downtrend

- Includes a bearish and bullish candle

- The bullish candle opens lower than the close of the bearish candle

- Bullish candle then closes above the 50% level of the bearish candle body

What does this tell traders?

- Potential trend reversal to the upside (bullish reversal)

- Bears (sellers) are losing impetus at this key price level

Advantages of trading with the bullish engulfing candle:

- Easy to identify for both novice and experienced traders

- Possibility of favourable risk-reward ratios

- Desirable entry levels can be obtained after confirmation of the piercing pattern

Trading with the Piercing Line Pattern: Top Tips & Strategies

The weekly EUR/USD chart above shows the presence of a piercing pattern highlighted in blue. Preceding this pattern is a strong downtrend as indicated by lower lows and lower highs. This example illustrates the use of price action to determine the downtrend, however, traders often prefer the use of a technical indicator such as the moving average for confirmation (price needs to be above the long-term moving average).

As mentioned previously, the piercing pattern does require further confirmation before entering into a long trade. In this example, the RSI oscillator has been used as additional confirmation of a reversal. From the chart, the RSI indicates an oversold signal which reinforces the validity of the piercing pattern.

Stop levels can be placed at the recent low (low of the bullish piercing pattern candle), while the take profit (limit) can be identified using Fibonacci extensions or price action.

How reliable is the piercing line?

Piercing line patterns signal bullish reversals however, the reliance of this pattern alone is not recommended. Further support signals should be used in concurrence with the piercing pattern. Trading against a dominant trend can be risky so finding multiple confirmation signals is encouraged to verify the pattern.

| Advantages | Limitations |

|---|---|

| Occurs frequently within financial markets | Signifies bullish reversal patterns only |

| Opportunity for favourable risk-reward ratios | Trading the piercing pattern requires the use of other technical indicators and oscillators |

| Piercing patterns are easy to identify for novice traders | Entails looking at the overall market trend and not just the candlestick pattern in isolation |

Learn more about trading with candlestick patterns

- Further your knowledge on other candlestick patterns with our guides to:

1. Rising wedge and falling wedge patterns

3. Double top

- We also recommend checking out our guide on How to Read Candlestick Charts for a quick recap of candlestick trading.