- Updated levels on trade setup we’ve been tracking in Loonie (USD/CAD) & Aussie (AUD/USD)

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30 GMT (8:30am ET)

- Check out our 2018 projections in our Free DailyFX US Dollar Trading Forecast s

Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

USD/CAD 240min Price Chart

In this week’s Canadian Dollar Price Outlook we noted that, “From a trading standpoint, the near-term risk is weighted to the downside after Friday’s reversal but initial monthly-open support rests just lower at 1.3388.” A brief stint below this level yesterday registered a low at 1.3357 (just pips from the 1.3354 confluence support zone) before reversing sharply higher with USD/CAD breaking above the 61.8% retracement / weekly opening-range high today at 1.3454/56.

Look for support ahead of the 1.3435/37 confluence zone IF price is heading higher on this stretch with near-term topside objectives at the May high at 1.3514 and 1.3537- a breach / close there would be needed to validate a breakout of the monthly range. A break of the lows would expose the 78.6% retracement at 1.3309.

New to Forex? Get started with our Beginners Trading Guide !

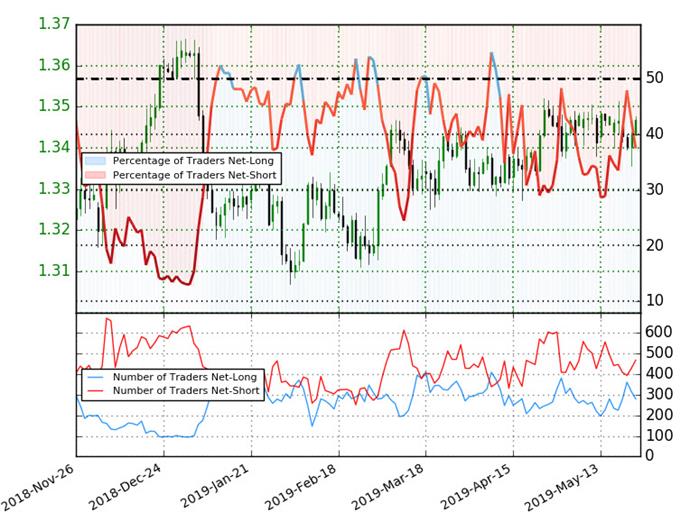

USD/CAD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-short USD/CAD - the ratio stands at -1.67 (37.4% of traders are long) – bullish reading

- Long positions are 29.5% lower than yesterday and 2.9% higher from last week

- Short positions are 14.4% higher than yesterday and 11.2% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger USDCAD-bullish contrarian trading bias from a sentiment standpoint.

See how shifts in Loonie retail positioning are impacting trend- Learn more about sentiment!

AUD/USD 120min Price Chart

In my most recent Australian Dollar Price Outlook we noted that Aussie had, “filled the Sunday gap with the weekly opening-range set just above the yearly low at 6866.” The range remains intact heading into the close of the close on Thursday with price now poised to mark an outside-day reversal off the lows is Aussie closes at these levels.

Weekly open resistance stands at 6911 backed closely by the upper parallel of the pitchfork we’ve been tracking since the monthly high- ultimately a topside breach / close above 6934 is needed to suggest a larger recovery is underway. A break lower would still risk a drop towards 6854 and 6828- looking for a bigger reaction off one of those levels IF reached. Review my latest AUD/USD Weekly Price Outlook for a look at the longer-term technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex