- Updated levels on trade setup we’ve been tracking in EUR/USD and AUD/JPY

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX EUR/USD Trading Forecasts

New to Forex? Get started with our Beginners Trading Guide !

EURUSD 240min Price Chart

In this week’s EUR/USD Price Outlook, our ‘bottom line’ stated that, “An outside-day reversal yesterday does cast a bearish tone on price near-term but we’re looking for exhaustion on a move lower for re-entry. From a trading standpoint, I’ll favor fading weakness while above 1.1312 for now with a breach above 1.1516 needed to fuel the next leg higher in price.” A late-week break below the opening-range has Euro approaching a key near-term support confluence at 1.1312/20 (note the 100% extension of the recent decline).

Prices would need to stabilize above the lower parallel (weekly close would be nice) to keep the advance viable with a breach above the weekly open resistance at 1.4113 needed to shift the focus higher in Euro. Topside objectives unchanged at 1.1472 backed by 1.1508/16 and the 100-day moving average at ~1.1546. A break below this formation exposes 1.1271 backed by 1.1216 and the 61.8% retracement at 1.1187. Review this week’s Strategy Webinar for an in-depth breakdown of these setup and more.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

AUD/JPY 240min Price Chart

Earlier this week we highlighted a reversal in AUD/JPY as price approaching, “the first major support zone at 81.23/34 - this region is defined by the 38.2% retracement of the advance off the yearly low, the 100-day moving average and the 100% extension of the decline off the monthly high.” Price registered a low at 81.19 this week before rebounding sharply with the rally failing ahead of weekly-open resistance at 82.40. So was that it?

The jury is still out but the focus heading into next week is on validating an exhaustion on low with one last drop towards 80.80 (to offer re-entry on the long-side) OR a break above the monthly high-day close at 82.75 to validate a larger breakout targeting 83.05 and 83.26. We’re also tracking a similar setup in AUD/USD. Review the latest AUD/JPY Weekly Technical Outlook for a longer-term look at weekly price action.

Learn the traits of a successful trader in our free eBook!

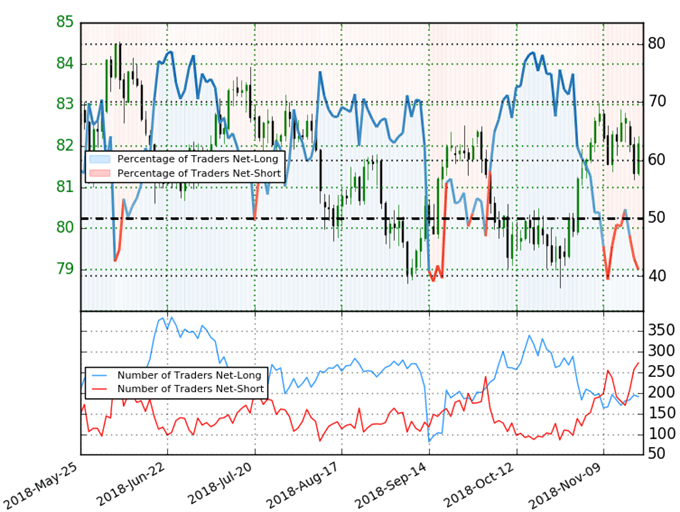

AUD/JPY Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-short AUD/JPY - the ratio stands at -1.43 (41.2% of traders are long) – bullishreading

- The percentage of traders net-long is now its lowest since November 13th

- Long positions are0.5% lower than yesterday and 2.1% lower from last week

- Short positions are 25.8% higher than yesterday and 38.6% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/JPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger AUD/JPY-bullish contrarian trading bias from a sentiment standpoint.

Find yourself getting trigger shy or missing opportunities? Learn how to build Confidence in Your Trading

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex or contact him at mboutros@dailyfx.com