- Update on trade setup we’ve been tracking inEUR/USD and USD/JPY

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

New to Forex? Get started with our Beginners Trading Guide !

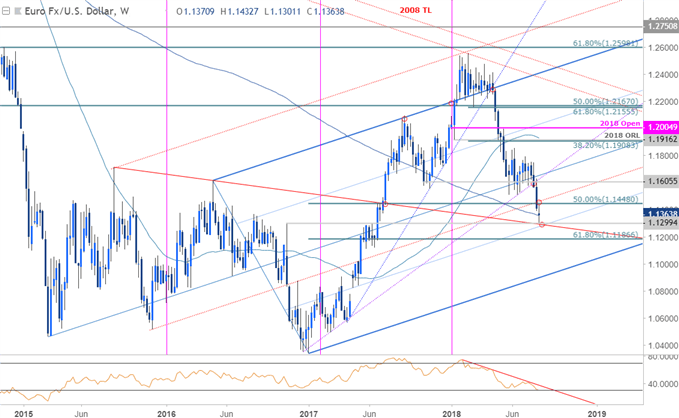

EUR/USD Weekly Price Chart

We’ve been tracking this long-term slope in EUR/USD for months now with the break below 1.1605 shifting our focus lower in Euro. Yesterday we highlighted near-term down-trend support heading into the 1.13-handle with our focus on an exhaustion low in price.

Price registered a low at 1.1301 before reversing sharply- note that this region is defined by the confluence of former trendline resistance extending off the late-2015 swing high (red) and operative 50-line of the ascending pitchfork formation (blue). IF price is going to get a near-term recovery, this would be a good place to look- willing to play the long-side for now. Intraday trading levels remain unchanged from this week’s EUR/USD Scalp Report.

Learn the traits of a successful trader in our Free eBook!

USD/JPY Daily Price Chart

In this week’s Scalp report on the Japanese Yen, we highlighted bearish invalidation at 111.37 with our outlook weighted to the downside in the pair. Price registered a high at 111.43 before reversing sharply yesterday with USD/JPY breaking back below the weekly open in early US trade.

Bearish invalidation now lowered to 111.07 with our focus still on a drive in to a critical support confluence at, “109.80/91 where the 100 & 200-day moving averages converge on the 38.2% retracement of the March advance and pitchfork support”. Look for a reaction there - intraday trading levels remain unchanged from this week’s USD/JPY Scalp Report.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Find yourself getting trigger shy or missing opportunities? Learn how to build Confidence in Your Trading

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex or contact him at mboutros@dailyfx.com