Silver Tumbles Back into a Multi-Month Support Zone

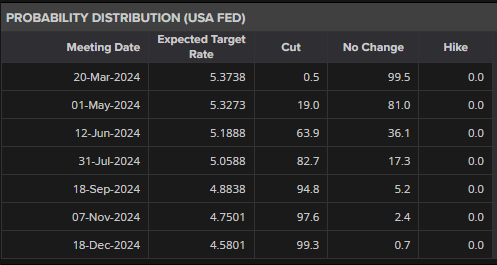

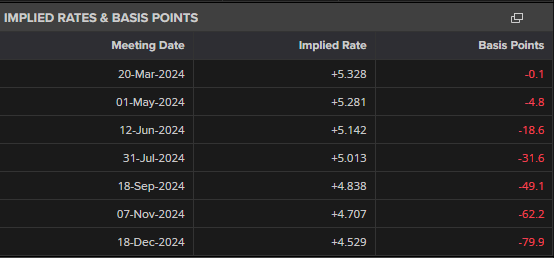

The recent hawkish re-pricing seen in the US interest rate market has weighed on silver and sent it tumbling. The latest market forecasts are for the US Federal Reserve to start cutting rates at either the June meeting – 64% probability – or at the July meeting – 82.7% probability.

The market is now predicting that the US central bank will trim just under 80 basis points off market borrowing costs, suggesting three 25 basis point rate cuts in the US this year. At the end of last year/start of 2024, the market forecast over 150 basis points of rate cuts with the first move priced in at next month’s meeting.

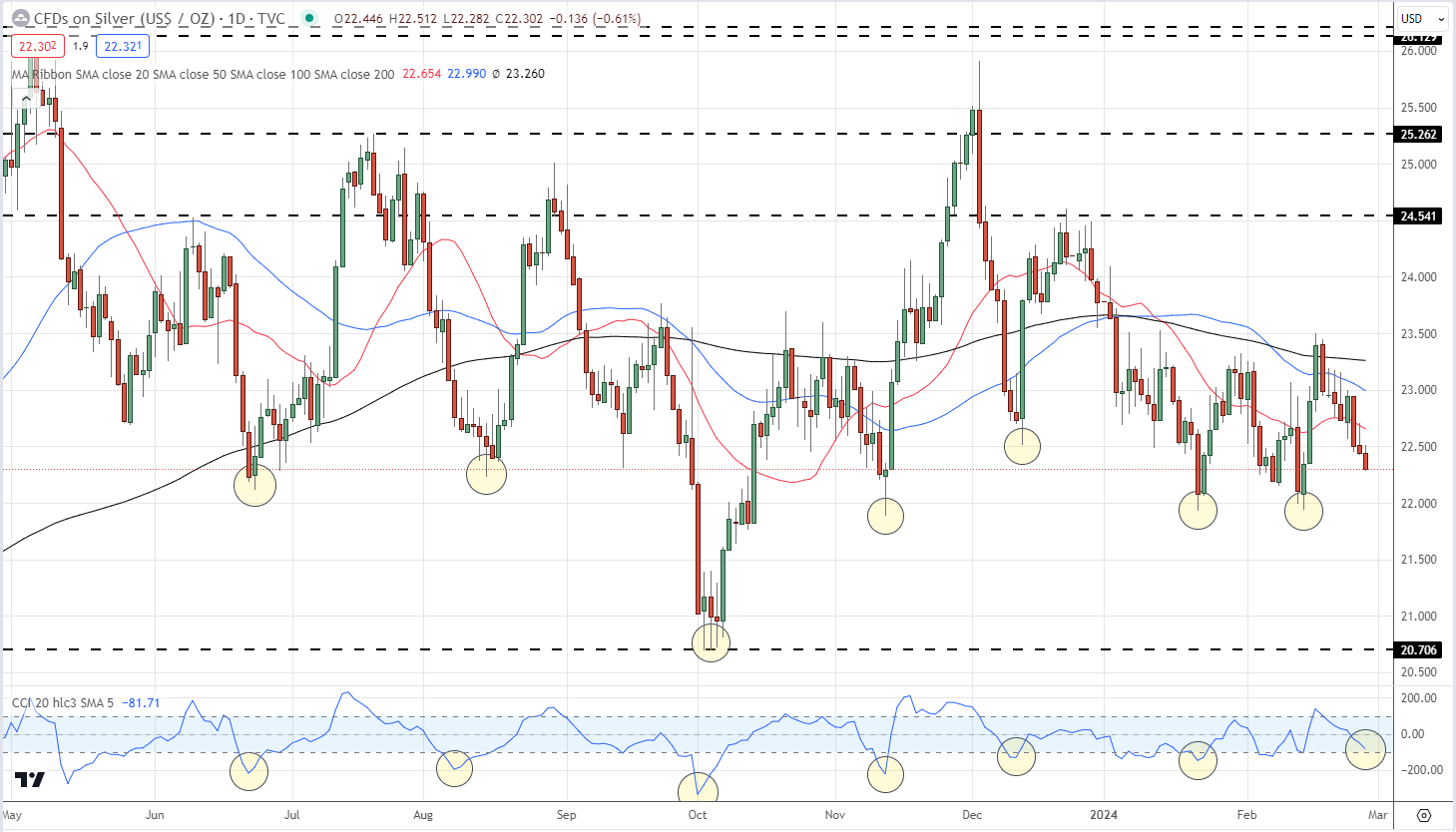

The daily silver chart has turned negative over the last two weeks with the metal printing a series of lower highs and lower lows and sliding below all three simple moving averages with relative ease. Silver is now back in a multi-month supportive zone and may test the $22 level again if sellers continue to run the market.

The daily chart does suggest that silver is oversold with the CCI indicator nearing levels that have sparked a rebound over the last few months. If silver can hold above the $21.94 level – the Jan 22nd and February 14th lows – the precious metal may look to reclaim the $23 level before eyeing the 200-day simple moving average currently at $23.30.

Silver Daily Price Chart Showing Oversold CCI Conditions

Chart via TradingView

Retail trader data shows investors remain heavily net-long silver. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

See how daily and weekly changes in IG Retail Trader data can affect sentiment and price action.

| Change in | Longs | Shorts | OI |

| Daily | 3% | 2% | 3% |

| Weekly | 4% | -9% | 2% |

What is your view on Silver – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.