- For trading ideas, please check out our Trading Guides. And if you’re looking for something more interactive in nature, please check out our DailyFX Live webinars.

To receive James Stanley’s Analysis directly via email, please sign up here.

This setup looks to take advantage of US Dollar volatility as we head into the end of the week.

I’ve recently caught my final limit in my last USD/JPY setup from the previous Analyst Pick. In that one, I had paired up long EUR/USD with long USD/JPY in the effort of hedging around the U.S. Dollar ahead of an expected interest rate hike from the Federal Reserve. The long EUR/USD piece was stopped out at break-even the morning of the rate hike, while the USD/JPY part of the setup hit its final limit at 113.25. (Another long EUR/USD setup was enacted last week, and remains active with one target remaining).

I had taken a GBP/USD setup earlier in the week and ate a stop, and at this point I believe that I was simply too early on the continuation trade. Since then, we’ve seen a return of bullish price action in Cable as the pair has broken-above a bull flag formation, (discussed in our GBP/USD Technical article earlier in the morning); so I will use this pair as my weak-USD leg for this USD-hedge. The long-USD portion will be in USD/JPY, as the pair appears to be in the process of working on a ‘higher-low’.

We still have considerable headline risk with day two of Fed Chair Janet Yellen’s Congressional testimony, so stops will be widened out to give each of these trades some room to work. This means position sizes will be lowered accordingly to compensate for wider stops.

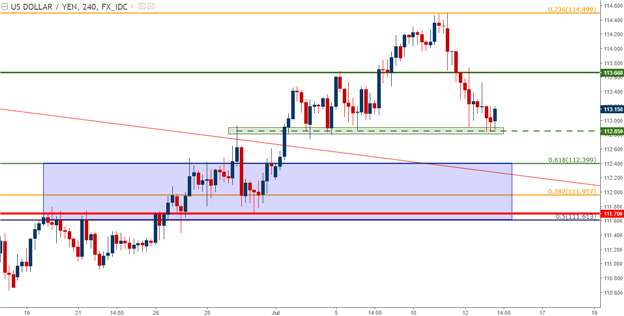

Long USD/JPY at Market

Stops below 111.70

Break-even stop move at 114.00

Target 1: 114.50

Target 2: 115.50

Target 3: 117.00

Chart prepared by James Stanley

Long GBP/USD at Market

Stops below 1.2800

Break-even stop move at 1.3000

Target 1: 1.3100

Target 2: 1.3250

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX