- If you’re looking for trading ideas, check out our Trading Guides. They’re free and updated for Q1, 2017. If you’re looking for ideas more short-term in nature, please check out our IG Client Sentiment.

To receive James Stanley’s Analysis directly via email, please sign up here.

The remainder of this week has heavy headline risk, and one of the few things that remains quite probabilistic is volatility in the U.S. Dollar as we head into what’s expected to be another interest rate hike from the Federal Reserve. The U.S. Dollar is incredibly weak as it furthers its 2017 down-trend, and this has showed even with the Fed remaining persistently-hawkish throughout the year.

This pair of setups looks to take a hedged approach around USD with long USD exposure sought in USD/JPY while short USD exposure is setup in EUR/USD. The goal of such a hedge is to walk away from tomorrow’s FOMC announcement with one side of the setup as a winner while the other gets stopped out by a lesser amount than what the ‘winning’ side of the hedge may run for. The net effective exposure of this setup is long EUR/JPY: But the goal here is to use the price action setup in long EUR/JPY to try to position-in around the Dollar, looking to pair USD with what’s been a strong Euro and, at least up until recently, a weak Yen. Note – it is possible to lose on both sides of a hedge. Such a strategy looks to mitigate risk around ‘big’ headline-moving events; but complete elimination of risk is not possible while carrying exposure, particularly around highly-volatile periods in the market as we’re expecting for the remainder of this week.

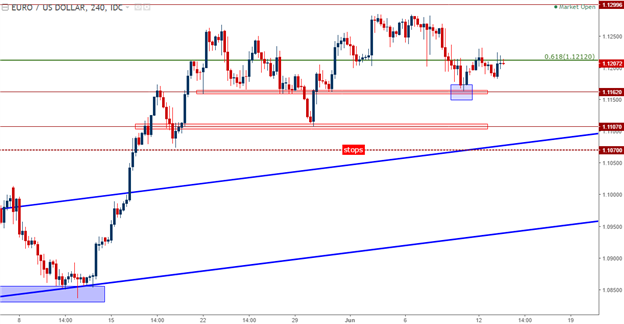

Long EUR/USD, stops below 1.1070

Break-even stop move at 1.1295

Target 1: 1.1360

Target 2: 1.1500

Chart prepared by James Stanley

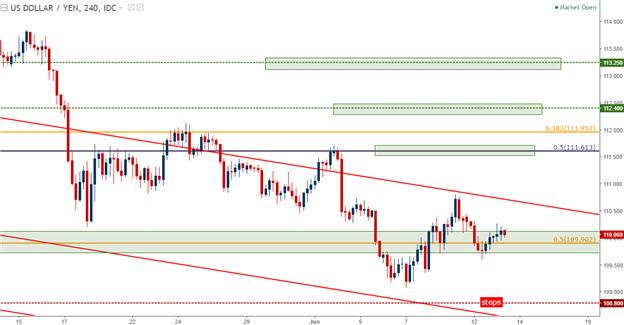

Long USD/JPY, stops below 108.80

Break-even stop move at 110.70

Target 1: 111.61

Target 2: 112.40

Target 3: 113.25

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX