AUD/NZD Trading Strategy – Long at 1.09168

- Markets are starting to slowly price in an RBNZ rate cut in 2019 while RBA bets are for hikes

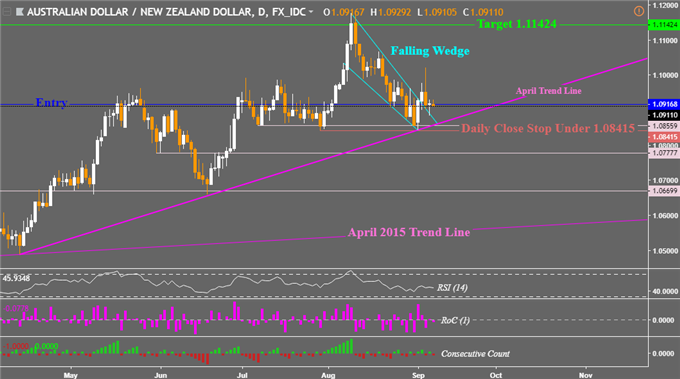

- A bullish reversal pattern formed on the AUD/NZD daily chart, April dominant uptrend holds

- Now long AUD/NZD at 1.09168 targeting near the August highs, daily close stop under 1.08415

Follow Daniel @ddubrovskyFX on Twitter to stay updated on this setup where you may also ask him your questions

AUD/NZD Fundamentals

Since we last looked at AUD/NZD, the fundamental landscape has somewhat changed. But it further supports an argument for a bullish bias. In August, the RBNZ left rates unchanged and signaled that a rate hike would be further out. Do also keep in mind that Governor Adrian Orr has noted that a cut to the OCR is just as likely as a hike.

Meanwhile, the Reserve Bank of Australia and Governor Philip Lowe expressed their bias for a rate hike as opposed to a cut when they next change monetary policy. Though Mr. Lowe has mentioned that an adjustment ‘still seems some way off’. So relatively speaking, the Reserve Bank of New Zealand seems more dovish than its Australian counterpart.

Since their respective monetary policy announcements, the markets have slowly started pricing in an RBNZ rate cut. Especially after 10-year low New Zealand business confidence sunk the New Zealand Dollar. Overnight index swaps are now pricing in a 28.0% chance that the central bank could cut rates in February 2019. Meanwhile, RBA rate hike bets stand at around 49.1% confidence for October 2019.

With that in mind, we may see AUD/NZD rise in the long-run if those expectations transpire. But there are risks. These are mainly how local economic data perform. Since both currencies are sentiment-linked, AUD/NZD tends to net out market mood swings which places the focus for it on RBA & RBNZ monetary policy expectations. The former could be adversely impacted by a weak Australian jobs report on September 13th. Another risk for AUD/NZD bulls is if Australian banks continue raising mortgage rates.

AUD/NZD Technical Analysis

Taking this into account, we still remain fundamentally biased to the upside for AUD/NZD despite its recent pullback from the August highs. Looking at the technicals shows that the pair may resume its uptrend from April. On the AUD/NZD daily chart below, a falling wedge bullish reversal pattern has formed signaling that continuation of the dominant trend could ensue.

With that in mind, we have entered long at 1.09168 targeting the August highs around 1.11424. A stop will be activated via a daily close under 1.08415. This would also mark a break under the rising trend line from April, which might signal that the dominant uptrend could be overturned. A 3-to-1 risk reward ratio is used in this setup.

Chart created in TradingView

Build confidence in your own AUD/NZD strategy with the help of our free guide!

FX Trading Resources:

- Join a free Q&A webinar and have your trading questions answered

- See how AUD and NZD are viewed by the trading community at the DailyFX Sentiment Page

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Just getting started? See our beginners’ guide for FX traders

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com