Multiple time frame analysis follows a top down approach when trading and allows traders to gauge the longer-term trend while spotting ideal entries on a smaller time frame chart. After deciding on the appropriate time frames to analyze, traders can then conduct technical analysis using multiple time frames to confirm or reject their trading bias.

Keep reading to learn more:

- What is multiple time frame analysis

- What forex time frames can be applied in multi-time frame analysis

- Multiple time frame analysis techniques for day traders

- Multiple time frame analysis techniques for swing traders

What is multiple time frame analysis?

Multiple time frame analysis, or multi-time frame analysis, is the process of viewing the same currency pair under different time frames. Usually the larger time frame is used to establish a longer-term trend, while a shorter time frame is used to spot ideal entries into the market.

The rule of thumb is to use a ratio of 1:4 or 1:6 when switching between time frames. The logic behind this approach is to be able to uncover the smaller, intricate movements in price for well-timed entries into the market. That being said, it is of little use to focus on extremely small time frames because most of the price movement has little bearing on the overall trade and can lead to unnecessary stress when the market seem to be moving quickly.

Considering an example, when viewing the trend on an hourly chart, traders can zoom into the 10-minute chart (1:6) or the 15-minute chart (1:4) for suitable entries. The 10 or 15-minute chart provides an indication of shorter term developments and the hourly chart is where the trade’s progress can be monitored going forward.

How to identify the best forex time frame?

Many traders, new and experienced, want to know how to identify the best time frame to trade forex. In general, traders should select a time frame in accordance with:

- the amount of time available to trade per day

- the most commonly used time frame utilized to identify trade set ups

For example, individuals that scan the forex market using daily charts, while only being able to dedicate one hour a day in front of the charts, are better off using the daily time frame for analysis and a four-hour chart for the entry trigger. Those with more time to dedicate to the market, can make use of much smaller time frames as they are able to analyze the market and act quickly when opportunities arise.

Table:General time frames of different traders

| Trader style | Holding period | Trend chart | Entry chart |

|---|---|---|---|

| Long-term | 1 day + | Weekly | Daily |

| Swing-trader | Few hours – few days | Daily | 4-hour |

| Short-term | < 1 day | 4-hour | Hourly |

| Scalper | < few hours | hourly | 15-minute |

What type of trader are you? Find out in our guide to the different forex trader types.

Multiple time frame analysis techniques for day traders

Day traders typically have the whole day to monitor charts and therefore, can trade with really small time frames. These range anywhere from a one-minute, to the 15-minute, to the one-hour time frame. Day traders that identify their trade set ups on the one-hour time frame can then zoom into the 15-minute time frame to spot ideal market entries.

Trend time frame: One-hour chart

Entry time frame: 15-minute chart

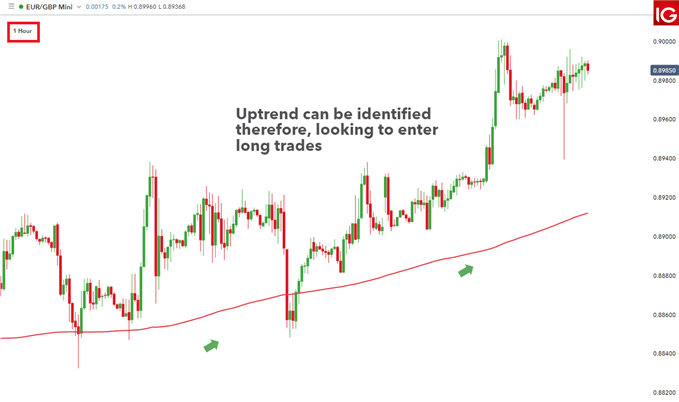

Day traders can look at the one-hour chart to establish the trend. Price trades predominantly above the 200 MA and is moving upwards, hence the long trading bias. Day traders can then zoom into the 15-minute chart to spot ideal entries.. Day traders can then zoom into the four-hour chart to spot ideal entries.

EUR/GBP one-hour chart exhibiting an upward bias

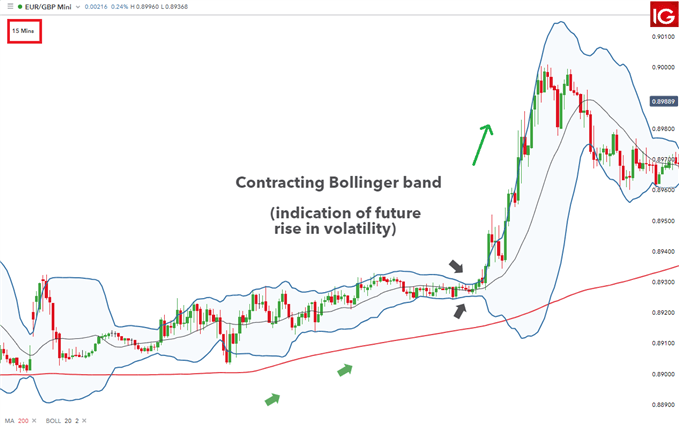

The 15-minute chart allows day traders to get a closer look at how price is evolving on the lower time frame. The uptrend is also apparent on the 15-minute chart which confirms the upward bias. The two black arrows point towards the contracting Bollinger band ® which often precedes an increase in volatility. Traders can enter the long position once price penetrates the upper band and use either the 20 day MA or lower band as a dynamic stop.

EUR/GBP 15-minute chart showing ideal entry into the market

Multiple time frame analysis techniques for swing traders

Swing traders tend to have significantly less time to spend monitoring charts when compared to day traders – perhaps one hour or less. Thus, swing traders will look to the daily chart for the overall trend and then zoom in to the four-hour chart to spot entries.

Trend time frame: Daily chart

Entry time frame: Four-Hour chart

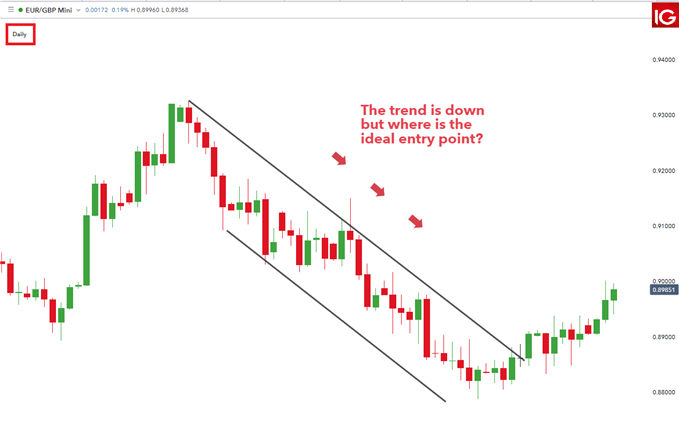

The Daily time frame on EUR/GBP allows traders to spot the downtrend but where is the ideal entry into the market? Zooming into the four-hour time frame sheds more light on this.

EUR/GBP Daily chart exhibiting downward trend

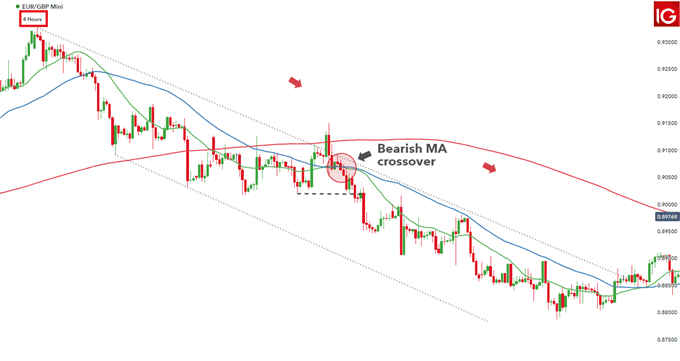

Zooming into the four-hour chart, traders can look for short signals. Note the upper and lower channel lines are now faint dotted lines to keep the chart clean. After a failed breakout, price drops back within the trading range. A failed move higher creates further conviction for the short trade.

Price is trading below the 200-day SMA and once back within the range there is a bearish crossover as the 20 MA (green line) crosses below the 50 MA (Blue line), providing the entry trigger.

EUR/GBP Four-hour chart filtering trades in favor of short positions

Further reading on time frame analysis

- Get comfortable with changing chart time frames by viewing our live charts.

- Multiple time frame analysis can only be utilized once a desired market has been chosen. IG Client Sentiment can help with this - learn how to use client sentiment to identify suitable markets.

- Find out what trading style matches your trading personality.

- When identifying the long term trend, many traders make use of the 200 day simple moving average because of its longstanding reputation of being a good indicator of long term trend.