Core-Perimeter Trading Model

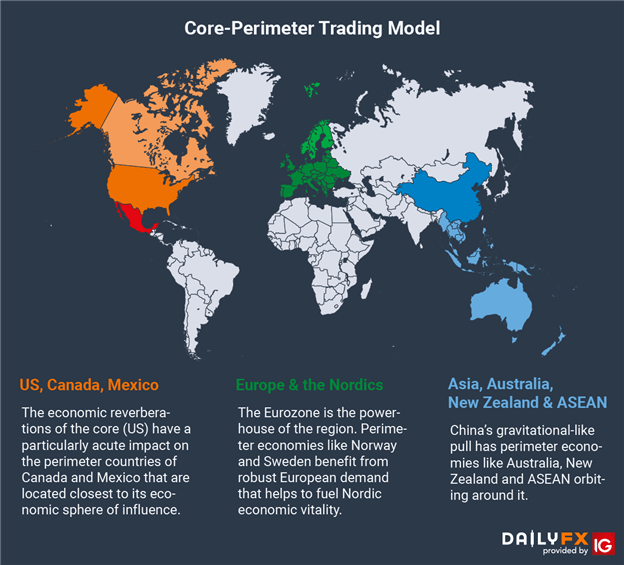

Three economic powerhouses are the primary drivers of the global economy: the US, China and EU. Surrounding each of these growth nodes are perimeter economies that strongly rely on the performance of the core. These are typically export-oriented countries whose fortunes oscillate with greater frequency and magnitude to changes in the global business cycle and underlying market sentiment than their core counterparts.

Assets within these perimeter countries frequently carry higher yields, offering more generous returns for the additional risk investors incur when they invest there. In an environment where markets are generally optimistic about the outlook for global growth, traders prioritize returns over safety and usually opt for comparatively riskier – that is, more cycle-sensitive – assets. This is then reflected in capital flowing to export-oriented countries; or rather from core to perimeter.

However, in a market downturn, investors are animated by a desire to preserve capital (or at the very least to minimize losses) rather than maximize returns. In this situation, investors usually shift to assets offering lower yields but that are less risky. This is usually reflected in capital flowing out of perimeter economies and into the core, where it is parked until conditions improve.

The Core-Perimeter framework allows traders to understand the macro-fundamental interactions between powerhouse economies and their perimeter counterparts, offering valuable insight on how to trade the assets embedded in these relationships.