EUR/USD OUTLOOK:

- EUR/USD lacks strong directional conviction as market mood remains cautious

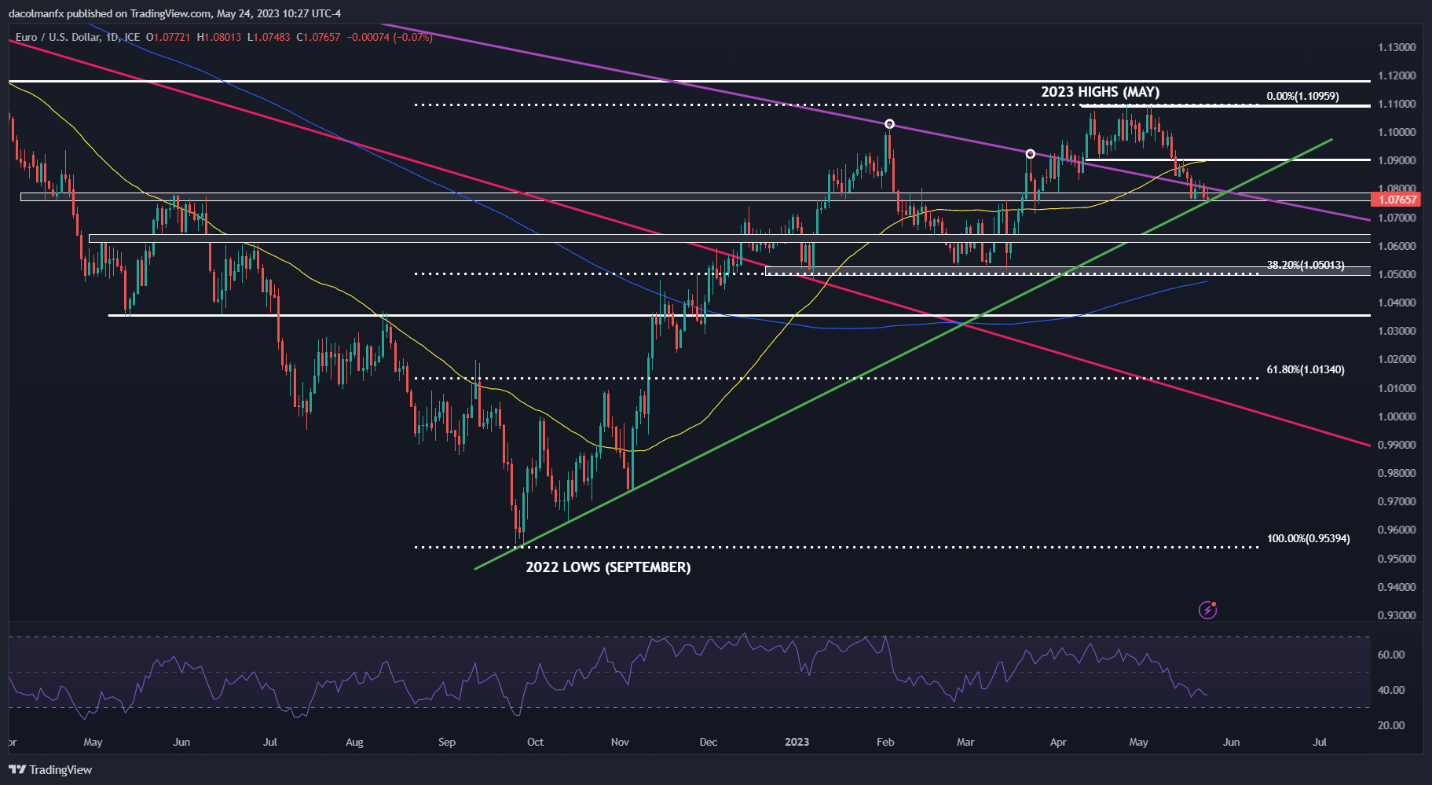

- While euro remains biased to the upside over a medium-term horizon, the outlook could change if prices break below an important support zone

- This article looks key technical levels to watch in the coming days

Most Read: EUR/USD on Cusp of Major Breakdown as US Dollar Embarks on Strong Recovery

EUR/USD was virtually flat on Wednesday in early morning trading in New York, oscillating between small gains and losses around the $1.0768 mark, a sign of indecision amid market caution due to the U.S. debt ceiling standoff and growing fears of a potential technical default.

In the grand scheme of things, the euro remains biased to the upside over a medium-term horizon against the U.S. dollar, indicating that the recent pullback that has led to a nearly 3% drop from the May high may be part of a corrective movement within a broader uptrend.

Although the correction theory remains valid for now, the arguments in its favor have started to weaken, especially after the exchange rate broke below the 50-day simple moving average a few days ago, signaling a possible reversal.

| Change in | Longs | Shorts | OI |

| Daily | 10% | 1% | 6% |

| Weekly | -14% | 15% | -3% |

Related: Japanese Yen Setups - USD/JPY Muted After Breakout, AUD/JPY Forges Double Top

All hope is not yet lost, but to be confident in the EUR/USD's ability to resume its bullish run, the rising trendline that has guided the pair's advance since September 2022 must hold all costs. This dynamic floor, currently crossing 1.0765/1.0760, is likely the last line of defense against a deeper decline.

If bulls fend off the attack on 1.0765/1.0760 successfully and spark a turnaround, initial resistance appears near the psychological 1.0900 level, but further gains may be in store on a push above this ceiling, with the next upside target at the 2023 highs.

In contrast, if 1.0765/1.0760 caves in decisively, bearish impetus may gather pace, emboldening sellers to launch an assault on 1.0625, the next relevant support to keep an eye on. On further weakness, the focus shifts lower to 1.0500, the 38.2% Fibonacci retracement of the 2022/2023 rally.

EUR/USD TECHNICAL CHART