EUR/USD FORECAST

- EUR/USD falls and tests trendline support amid broad-based U.S. dollar strength

- The recent jump in U.S. Treasury yields has reinforced the greenback’s recovery

- This article focuses on euro’s key technical levels to watch in the coming days

Most Read: Gold Fades but Upside Still Favored as Debt-Limit Talks Hit Crunch Time

The U.S. dollar has recently embarked on a strong recovery, driven by rising U.S. Treasury yields thanks to the exceptionalism of the U.S. economy. U.S. business activity and the labor market have held up remarkably well over the past few months despite numerous headwinds, including the banking sector turmoil that erupted in March.

Economic resilience has led some Fed officials (Bullard, for example) to take a more hawkish stance, leading them to support additional tightening and higher-for-longer rates. Against this backdrop, yields have rebounded significantly, with the 2-year note rising from a low of 3.65% this month to 4.4% at one point on Tuesday morning, a significant move in a short period of time by bond market standards.

The resurgent U.S. dollar has hurt most developed-market currencies, such as the euro and the yen. For instance, EUR/USD has fallen nearly 3% from its May peak, although some idiosyncratic factors have also contributed to the common currency's underperformance, such as the slump in manufacturing activity in Germany.

Related Reading: Nasdaq 100 Entrenched in Indisputable Uptrend but Poor Market Breadth Is Ominous

Looking ahead, there is reason to believe that the U.S. dollar could retain the upper hand for a little bit longer. One potential bullish catalyst is the U.S. debt ceiling impasse. Volatility could increase dramatically in the coming days if Congress fails to reach an agreement to lift the country's borrowing capacity soon, boosting safe-haven demand.

While lawmakers are likely to reach a deal at some point, that may not happen until the eleventh hour, when markets have already begun to convulse. History suggests that only panic tends to unite political parties in Washington. As the market becomes more nervous about a possible US default, EUR/USD could extend its slide near term.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

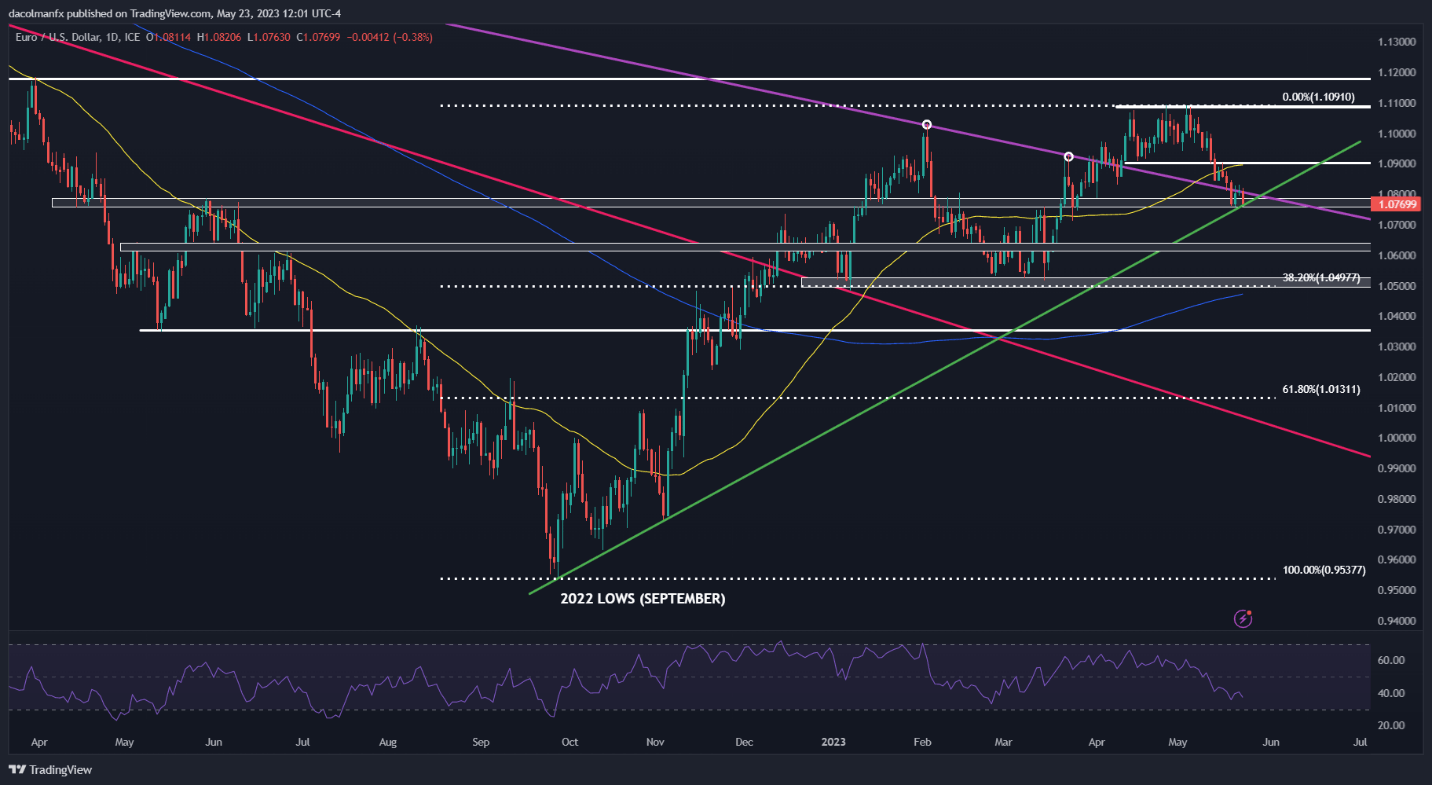

EUR/USD TECHNICAL ANALYSIS

After the recent pullback, EUR/USD is testing trendline support near 1.0775/1.0770, that last line of defense against a deeper retrenchment. If bulls fail to protect this floor and prices slide beneath it, selling pressure could accelerate, setting the stage for a move toward 1.0625.

On the flip side, if the pair manages to establish a base around current levels and reverses higher in the direction of the broader trend, initial resistance appears at the psychological 1.0900 mark, a tad above the 50-day simple moving average. On further strength, the focus shifts to the 2023 highs.

EUR/USD TECHNICAL CHART